What’s the Difference Between Tax Deed and Foreclosure Surplus Funds?

If you’ve lost a property to a foreclosure or tax deed sale in Florida, you may have heard the term “surplus funds.” But what many people don’t realize is that not all surplus funds are the same — and the process to claim them depends on how the property was sold.

In this post, we’ll break down the key differences between foreclosure surplus and tax deed surplus funds, and what it means for you as a former property owner or heir.

What Are Surplus Funds?

In both foreclosure and tax deed sales, surplus funds are the extra money left over after all debts have been paid and the property is sold.

Example:

If a property sells at auction for $200,000 and the outstanding debt is $150,000, there may be a $50,000 surplus available to the rightful claimant.

Foreclosure Surplus Funds: What You Need to Know

A foreclosure sale usually happens when a homeowner defaults on their mortgage. The lender files a foreclosure lawsuit, and the home is eventually sold at auction by the Clerk of Court.

Key Details:

The surplus funds are the amount over what was owed on the mortgage and any junior liens.

These funds are held by the court.

Only the owner of record at the time of the foreclosure judgment — or their legal heirs — may claim the funds.

The claim must be filed with the court that handled the foreclosure.

Tax Deed Surplus Funds: What You Need to Know

A tax deed sale occurs when a homeowner fails to pay property taxes. The county eventually auctions the property to recover those unpaid taxes.

Key Details:

Surplus funds are any proceeds above the amount of unpaid taxes, interest, fees, and costs.

The money is not held by the court, but by the county (usually through the Clerk or Tax Collector).

The former property owner at the time the tax deed was issued (not necessarily the person who failed to pay taxes) may be entitled to claim.

Lienholders and government agencies may also have a legal right to part of the funds.

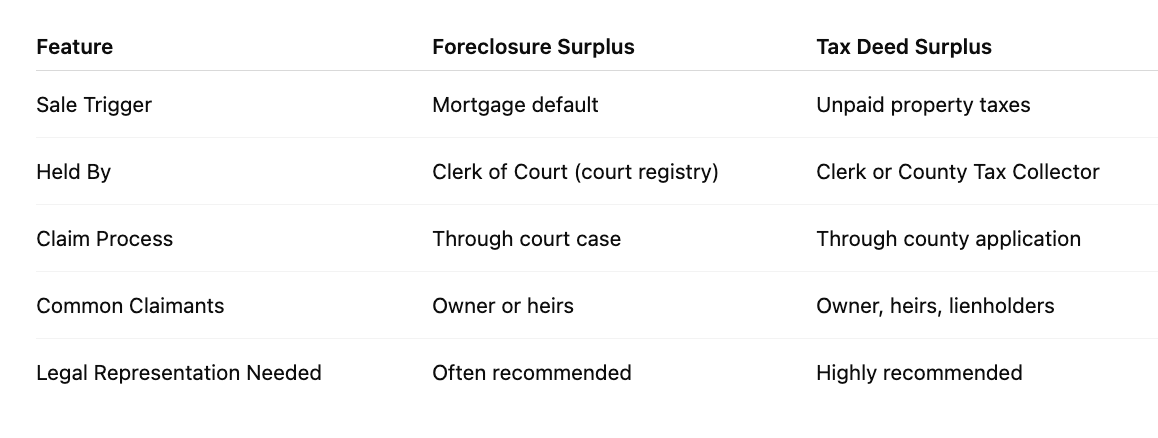

Foreclosure vs. Tax Deed Surplus: Quick Comparison

Why This Difference Matters

If you don’t understand the type of surplus you’re dealing with, you might:

File your claim in the wrong place

Miss important deadlines

Overlook lienholder priorities

Lose your right to the money altogether

We Help You Claim the Right Way — Fast

Whether your property was lost in a foreclosure or tax deed sale, we help determine:

If surplus funds are available

Who’s legally entitled to them

The exact process and paperwork needed to claim

You don’t have to navigate this alone. Let our experienced team — with legal support — handle everything for you.

Think You Might Be Owed Surplus Funds?

Let’s find out today — it’s free to check.

Click here to get started.