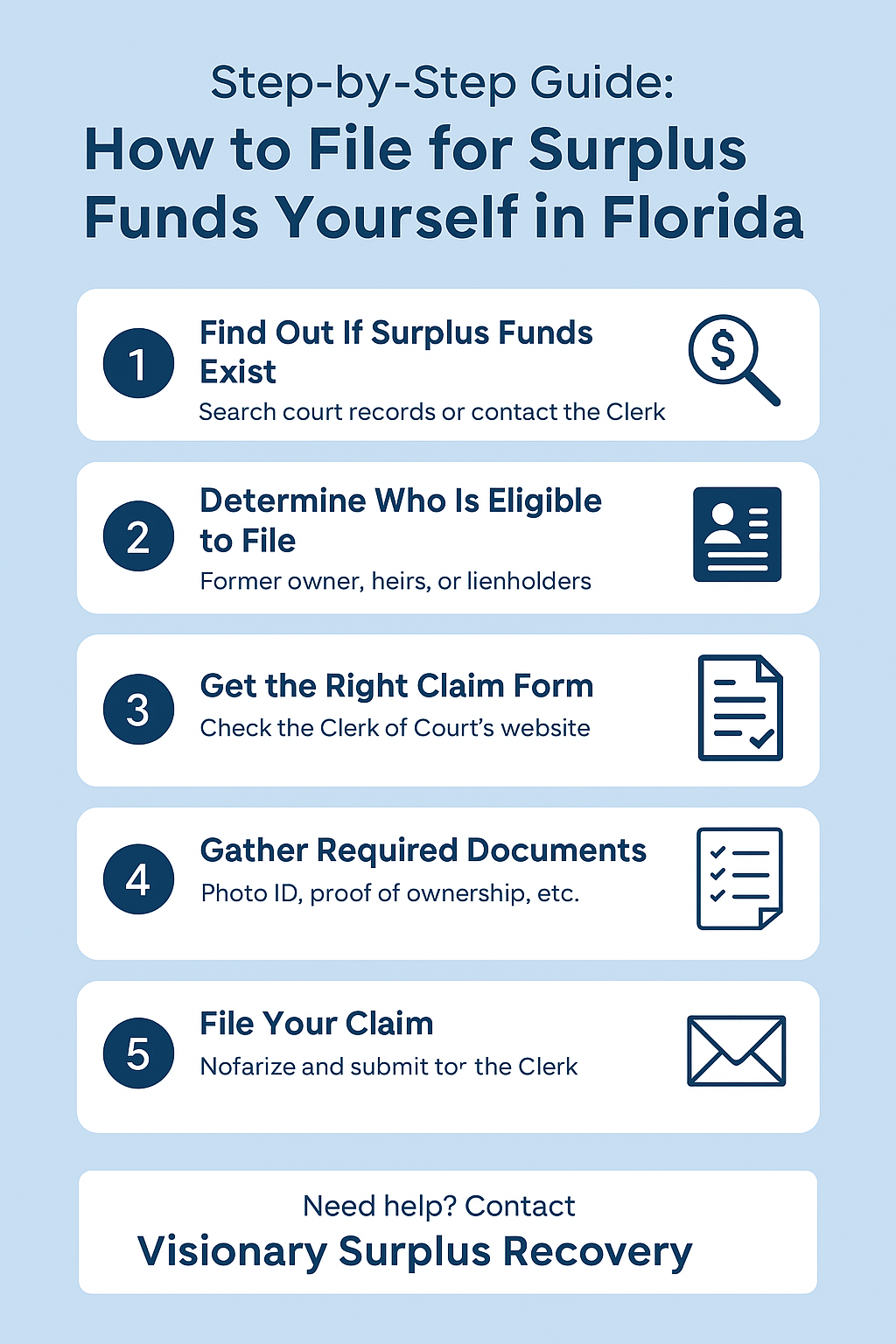

How to File for Surplus Funds Myself in Florida: A Step-by-Step Guide

If your property was sold in a foreclosure or tax deed sale in Florida, and the sale generated more money than was owed, you may be entitled to receive the surplus funds — the leftover proceeds after debts are paid.

Many former homeowners and heirs want to know:

“Can I file for surplus funds myself?”

Yes — in many cases, you can. But the process must be followed carefully to avoid delays, rejections, or even loss of your claim.

This guide walks you through the exact steps to file a surplus funds claim in Florida on your own.

Step 1: Find Out If Surplus Funds Exist

Before filing anything, you must confirm that:

Your property was sold in a judicial foreclosure or tax deed sale

The sale generated surplus funds

You’re legally entitled to claim those funds (as the former owner or rightful heir)

How to Check:

Search your case on the county Clerk of Court website

Call the Clerk’s Foreclosure or Tax Deed Department

Ask if a Notice of Surplus Funds has been issued

If funds exist, request a copy of the surplus notice and your case number.

Step 2: Determine Who Is Eligible to File

Only specific parties can file a claim:

The former property owner

Heirs (must show legal authority, often through probate)

Lienholders (must prove a valid, recorded lien)

Court-appointed guardians, trustees, or attorneys

If the former owner has passed away, probate is often required to appoint a personal representative before any claim can be filed.

Step 3: Get the Right Claim Form

Each county has a slightly different claim form. Most are found on the Clerk of Court’s website under “Foreclosure” or “Tax Deed Surplus.”

The form usually requires:

Your full legal name and contact information

The case number and property address

Statement of your right to claim funds (e.g. former owner, heir, lienholder)

Notarized signature

Optional: a request to waive a hearing if the amount is undisputed

🔗 Tip: If you can’t find the form online, call the Clerk and request the appropriate document.

Step 4: Gather Required Documents

Include the following with your claim:

A copy of your photo ID

Proof of ownership (e.g. deed or court records)

If claiming as an heir: a death certificate and proof of relationship

If using probate: Letters of Administration or court order

Any other documentation listed on the form

Step 5: File Your Claim

Once complete:

Notarize your form (required in most counties)

Make a copy for your records

Submit to the Clerk by mail, e-file system, or in-person (depending on county policy)

You may be required to:

Wait for a hearing

File a motion for disbursement if the Clerk cannot approve the claim directly

Respond to objections if someone else files a competing claim

How Long Does It Take?

Uncontested claims: 4–8 weeks in most counties

Contested or probate claims: Can take several months

Tax deed surplus: You only have 120 days before funds are transferred to the state!

Common Mistakes That Delay Claims

Using the wrong form or missing documents

Filing without probate authority as an heir

Submitting to the wrong department

Failing to meet the deadline (especially with tax deed funds)

Not addressing lienholders or competing claims

Want to pay for Counsel & file yourself?

W offer a one-time Surplus Filing Prep & Review service. For a flat fee, we’ll:

✅ Review your case details

✅ Provide all county-required claim documents

✅ Ensure the filing is 100% court-compliant

✅ Provide clear filing instructions customized to your county

This way, you stay in control of your claim, but with the confidence it’s being done right from the start.

Need Help Without Paying Upfront?

At Visionary Surplus Recovery, we file surplus claims every day — and we’ve seen what goes wrong when people try to do it alone without legal backup.

We offer:

Flat-fee and no-upfront-cost options

Attorney-assisted filings

Probate support when needed

Full transparency — no hidden fees

📞 Want to file your own claim but need help reviewing documents?

Get a free second opinion before filing:

👉 Start a Free Case Review

Disclaimer: This post is for informational purposes only and does not constitute legal advice. For help filing surplus fund claims or probate petitions, consult with a licensed Florida attorney.