Seminole County Florida Foreclosure Surplus Funds – Official Homeowner Guide

Understanding Foreclosure Surplus Funds in Seminole County, Florida

When a property in Seminole County, Florida is sold at a judicial foreclosure sale for more than the total amount owed under the final judgment, the remaining balance is known as foreclosure surplus funds or excess proceeds.

Under Florida Statute §45.032, these surplus funds do not belong to the lender or the bank. Instead, they are payable to the former homeowner or other legally eligible claimants, such as heirs, estates, or properly authorized assignees.

In Seminole County, foreclosure surplus funds are typically held in the court registry and administered by the Seminole County Clerk of the Circuit Court & Comptroller, Civil Court Services / Foreclosure Division. Funds remain on deposit until a verified claim is filed, reviewed, and approved. All disbursements are subject to court order and statutory compliance.

Former homeowners and families frequently search for:

surplus funds Florida

foreclosure surplus funds

how to claim surplus funds in Seminole County

Seminole County Clerk of Court surplus funds

foreclosure sale surplus

excess proceeds foreclosure Florida

unclaimed surplus funds Florida

former homeowner surplus funds

This guide explains the Seminole County foreclosure surplus funds process.

How Surplus Funds Are Created in Seminole County

Surplus funds arise when foreclosure sale proceeds exceed court-ordered obligations.

Judicial Mortgage Foreclosure Sales

If a property sells for more than the final judgment amount at public auction, the remaining balance becomes surplus funds held by the court.

HOA and Condominium Foreclosures

HOA and condominium association foreclosures are a common source of surplus funds in Seminole County, particularly in planned communities, townhomes, and condo corridors.

Junior Lien Foreclosures

Foreclosures initiated by junior lienholders may still generate excess proceeds depending on lien priority and sale price.

All foreclosure sale proceeds are deposited with the Clerk, and any surplus is held pending verified claim documentation.

Step-by-Step: How to File a Surplus Funds Claim in Seminole County

Successfully recovering surplus funds requires strict compliance with statutory and Clerk procedures.

1. Where Surplus Funds Are Held

Surplus funds are deposited into the court registry and administered by the Seminole County Clerk of the Circuit Court & Comptroller, Foreclosure Department.

2. Required Claim Forms

Most claims require:

Sworn statement executed under oath

Proper notarization

3. Required Documentation

Depending on claimant status, required documents may include:

Government-issued photo identification

Proof of ownership at the time of foreclosure

Recorded assignment agreements (if applicable)

Probate court orders or Letters of Administration (for estates)

4. Filing Deadlines

Florida law imposes strict statutory deadlines. Claims filed late may be denied or subordinated.

5. Clerk Review Process

The Clerk reviews claims for:

Completeness and accuracy

Verified claim documentation

Competing claims or liens

Compliance with Florida Statute §45.032

6. Court Order & Disbursement

Approved claims are paid only pursuant to court order. Disbursement is issued to the authorized claimant or legal representative.

Why Surplus Funds Claims Get Denied in Seminole County

Many claims are delayed or denied due to avoidable filing errors, including:

Incorrect or missing documentation

Probate not completed or improperly filed

Invalid or unenforceable assignment agreements

Competing claims or unresolved liens

Filing after statutory deadlines

⚠️ Important Notice:

Claims initially filed without professional representation that later require correction, amendment, or litigation may be subject to modified recovery terms, including a higher recovery fee, due to the additional legal and administrative work required.

Probate & Heirs: What Happens If the Owner Is Deceased

If the former homeowner passed away before or after the foreclosure sale, surplus funds become part of the estate.

When Probate Is Required

Multiple heirs exist

No surviving spouse listed on title

Ownership interests were not transferred prior to death

Summary vs Formal Administration

The type of probate required depends on estate value and complexity.

Why Counties Will Not Release Funds Without Authority

The Clerk cannot disburse surplus funds without valid probate court authority, regardless of family relationship.

Major Cities, Urban Areas & Neighborhoods in Seminole County

Major Cities & Municipalities

Sanford

Altamonte Springs

Lake Mary

Longwood

Casselberry

Oviedo

Winter Springs

High-Foreclosure Zip Code Areas (Examples)

32701

32707

32714

32750

32765

32771

Well-Known Neighborhoods & Communities

Wekiva Springs

Heathrow

Spring Valley

Alafaya Woods

Tuscawilla

Greenwood Lakes

Sweetwater Oaks

Common Foreclosure & Court Registry Streets

US Highway 17-92

State Road 436

State Road 434

Alafaya Trail

Ronald Reagan Boulevard

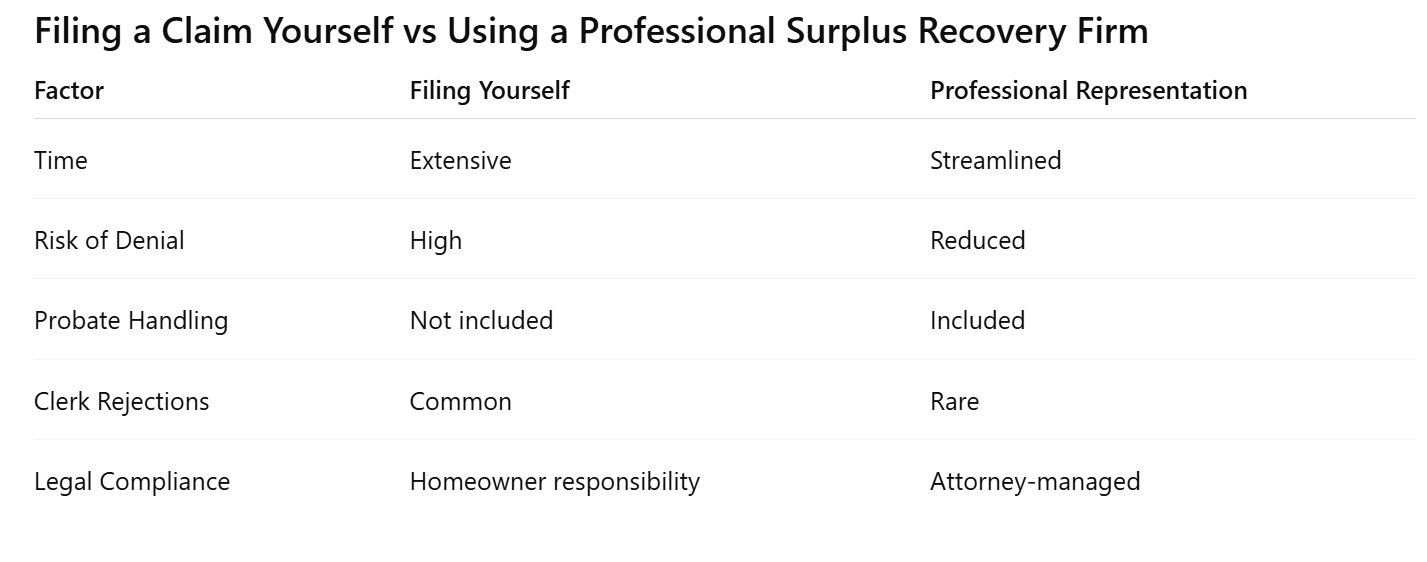

Filing a Claim Yourself vs Using a Professional Surplus Recovery Firm

What Happens If You Do Nothing

If no claim is filed:

Funds remain held in the court registry

Lienholders may intervene

Claims become more complex over time

Funds may eventually escheat to the state

Surplus funds are not automatically mailed to former homeowners.

Why Homeowners Choose Visionary Surplus Recovery

Visionary Surplus Recovery operates as the Equity Surplus Claims Department, providing:

Attorney-managed surplus funds claims

Clerk-compliant filings

Probate coordination included

No upfront fees

Faster processing and fewer denials

We regularly work with the Seminole County Clerk of the Circuit Court & Comptroller, Civil Court Services Division and Foreclosure Department to ensure filings meet procedural standards.

Pre-Foreclosure Help in Seminole County: Save Your Home or Sell Fast

If your Seminole County property is in pre-foreclosure, you may still have options to:

Stop foreclosure proceedings

Protect your equity

Sell your home before auction

Sell Your Home As-Is in as Little as 7 Days

Through Visionary Estates UPP LLC, homeowners can:

Sell as-is

Avoid repairs and commissions

Choose a fast closing timeline

📞 Call David – Cash Acquisitions Manager

813-335-8082

Ideal for homeowners searching:

sell my house fast Seminole County

stop foreclosure Florida

cash buyer Sanford

sell house before foreclosure auction

What Happens After You File a Claim

Clerk review typically takes 30–90 days

Court approval issued if required

Disbursement by check or approved method (wire or Zelle when authorized)

Timelines vary based on claim complexity and court involvement.

Frequently Asked Questions About Surplus Funds in Seminole County

How long does it take to receive surplus funds?

Most claims are processed within 30–90 days after court approval.

Does the bank receive the surplus?

No. Surplus funds belong to the former homeowner or eligible claimants.

Can I file a claim myself?

Yes, but many self-filed claims result in delays or denials.

What if multiple heirs exist?

Probate and court authorization are required.

Are foreclosure surplus funds taxable?

Consult a licensed tax professional.

Take the Next Step

Use our Free Surplus Eligibility Tool to determine whether foreclosure surplus funds are being held in your name in Seminole County, Florida.

Request a free, county-specific evaluation today — no upfront costs and no obligation.