What Is a Lis Pendens in Florida? (Complete Homeowner Guide)

What Is a Lis Pendens in Florida? The 67 Counties Guide (2026)

The Complete Homeowner, Heir, Estate and 67 Counties Guide (2026)

Discovering a lis pendens filed against your property in Florida can be frightening — especially if you don’t fully understand what it means or what happens next.

Many homeowners first learn about a lis pendens by:

Searching their name online

Receiving court mail they don’t understand

Being contacted by third parties

Seeing their property listed in public records

The biggest fear is usually the same:

“Am I about to lose my home?”

A lis pendens does not mean your home has already been taken, but it does mean a legal process has begun — most often foreclosure — and your property is now tied to a lawsuit.

This pillar guide explains everything you need to know about lis pendens in Florida, including timelines, foreclosure stages, homeowner rights, equity risks, surplus funds, and what options may still exist before and after auction.

If you’re reading this, you likely just discovered a lis pendens on your property in Florida and want clear answers.

A lis pendens is one of the most important legal notices you can find attached to your home — and understanding it early can literally save your equity, protect your rights, and give you options before foreclosure.

This definitive guide covers:

What a lis pendens is

How it works in Florida

Why it matters for every homeowner

Your rights and options

How it affects sales, equity, and foreclosure

Why county-specific context matters

How to protect your equity before and after foreclosure

What Does “Lis Pendens” Mean in Florida?

Lis pendens is a Latin term meaning “a lawsuit pending.”

In Florida real estate law, a lis pendens is a formal notice recorded in county public records stating that a property is involved in an active lawsuit that may affect ownership, title, or financial interest in the property.

In simple terms:

A lis pendens is a public warning that your property is tied to a legal dispute — and anyone dealing with it does so at their own risk.

Once recorded, it:

Attaches to the property (not just the owner)

Alerts buyers, lenders, and title companies

Prevents “innocent” transfers during litigation

Florida Lis Pendens Law (Statute §48.23 Explained Simply)

Lis pendens filings in Florida are governed by Florida Statute §48.23.

Under this statute:

Any party claiming a legal interest in real property may file a lis pendens

The notice remains effective while the lawsuit is pending

The lis pendens binds future buyers to the outcome of the case

⚠️ Important:

A lis pendens does not require court approval to file, which is why they are sometimes misused or misunderstood.

Why Is a Lis Pendens Filed in Florida?

While lis pendens can appear in many real estate disputes, foreclosure accounts for the overwhelming majority of filings involving homeowners.

Common Reasons a Lis Pendens Is Filed

Mortgage foreclosure lawsuits

HOA or condominium association foreclosures

Tax lien or municipal lien enforcement

Property ownership disputes

Estate or probate-related title issues

Real estate contract disputes

For most homeowners reading this, a lis pendens means a lender or HOA has officially sued to foreclose.

Does a Lis Pendens Mean Foreclosure in Florida?

In most homeowner cases, yes — but it does not mean foreclosure is complete.

A lis pendens usually marks the beginning of the foreclosure lawsuit, not the end.

What a Lis Pendens Means

The foreclosure lawsuit has been filed

The court case is now public

Ownership has not changed

No auction has occurred

What It Does NOT Mean

You do not automatically lose your home

You do not have to move out immediately

The property has not been sold

This stage is often the last meaningful opportunity to act.

Why County-Specific Context Matters

Florida is made up of 67 counties, and the way lis pendens interacts with:

Clerk of Court online systems

Auction calendars

Public records

Local foreclosure practices

…can differ from one county to the next.

That’s why we’ve created 67 county-specific lis pendens guides tailored to the legal environment in each Florida county with strategic insight into foreclosure patterns, clerks, and local nuances.

Scroll down later in this page to see each county’s section — from Miami-Dade to Walton County — linked for quick reference.

Florida Foreclosure Timeline: Where Lis Pendens Fits

Understanding the timeline helps homeowners regain control.

Typical Florida Foreclosure Process

Missed payments

Notice of default or demand letter

Lis pendens filed (lawsuit begins)

Court proceedings

Final judgment

Foreclosure auction

Certificate of title

Potential surplus funds

Foreclosure in Florida often takes many months, sometimes longer — but once judgment is entered, options narrow quickly.

HOA Lis Pendens vs Mortgage Lis Pendens

Not all lis pendens filings are equal.

HOA / Condo Foreclosures

Often smaller balances

Can move quickly

HOA may foreclose even if mortgage is current

Mortgage may survive HOA sale

Mortgage Foreclosures

Larger balances

Longer timelines

Can eliminate subordinate liens

More likely to produce surplus funds

Understanding which type applies is critical.

How Long Does a Lis Pendens Last in Florida?

A lis pendens does not expire automatically.

It remains until:

The case is dismissed

The foreclosure concludes

The court orders removal

The debt or dispute is resolved

This is why lis pendens filings can remain visible for months or even years.

Can a Lis Pendens Be Removed in Florida?

Yes — but only through action.

Ways a Lis Pendens May Be Removed

Lawsuit dismissal

Settlement or payoff

Court order for improper filing

Posting a bond (limited cases)

Completion of foreclosure

Ignoring it does not stop the process.

Can You Sell a House With a Lis Pendens in Florida?

Yes — but not through traditional means.

Once a lis pendens is recorded:

Title companies usually refuse to insure

Retail buyers walk away

Financing becomes impossible

However, selling before auction may still be possible with experienced distressed-property buyers.

IMPORTANT: If Your Property Has NOT Gone to Foreclosure Auction Yet

If your property is pre-auction, you may still have options to:

Stop foreclosure in all 67 Florida counties

Sell your house fast in all 67 counties

Receive a cash offer before foreclosure

Sell as-is and close in as little as 7 days

Through Visionary Estates UPP LLC, distressed homeowners may be able to preserve equity before auction instead of losing it through a forced sale.

📞 Call David – Cash Acquisitions Manager

813-335-8082

📧 cashoffers@visionrysurplusrecovery.com

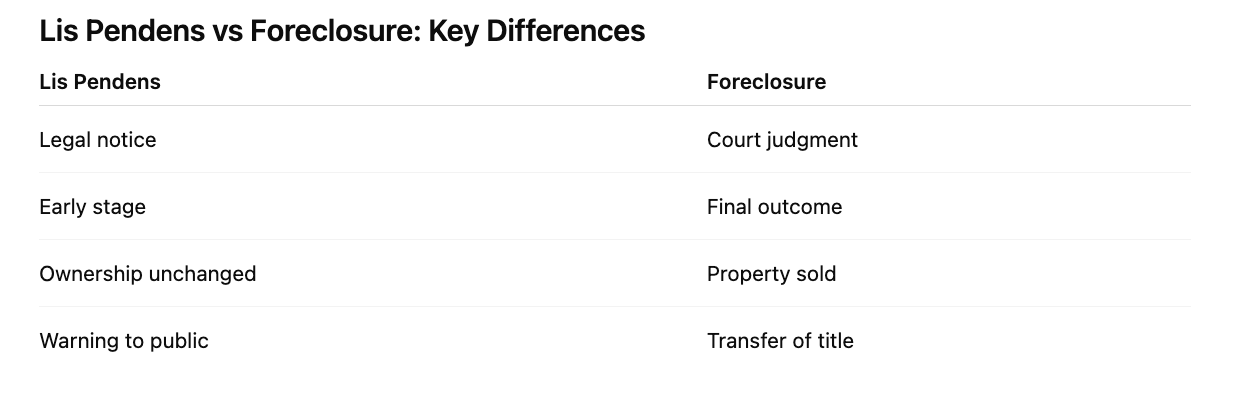

Lis Pendens vs Foreclosure: Key Differences

A lis pendens is a signal — not the final result.

What Happens If You Ignore a Lis Pendens?

Ignoring it can lead to:

Default judgment

Loss of defenses

Accelerated foreclosure

Loss of equity

Missed surplus funds

Many homeowners only learn the full impact after the auction is over.

County Index — Lis Pendens by All 67 Florida Counties

Alachua County

Baker County

Bay County

Bradford County

Brevard County

Broward County

Calhoun County

Charlotte County

Citrus County

Clay County

Collier County

Columbia County

DeSoto County

Dixie County

Duval County

Escambia County

Flagler County

Franklin County

Gadsden County

Gilchrist County

Glades County

Gulf County

Hamilton County

Hardee County

Hendry County

Hernando County

Highlands County

Hillsborough County

Holmes County

Indian River County

Jackson County

Jefferson County

Lafayette County

Lake County

Lee County

Leon County

Levy County

Liberty County

Madison County

Manatee County

Marion County

Martin County

Miami‑Dade County

Monroe County

Nassau County

Okaloosa County

Okeechobee County

Orange County

Osceola County

Palm Beach County

Pasco County

Pinellas County

Polk County

Putnam County

Santa Rosa County

Sarasota County

Seminole County

St. Johns County

St. Lucie County

Sumter County

Suwannee County

Taylor County

Union County

Volusia County

Wakulla County

Walton County

Washington County

What Are Surplus Funds After Foreclosure?

When a foreclosure sale generates more money than what is owed, the remaining funds are called surplus funds.

These funds may legally belong to:

Former homeowners

Heirs

Estates

Yet many never claim them — or worse, lose them to improper claimants.

Visionary Surplus Recovery: Protecting Equity & Surplus Funds

Visionary Surplus Recovery serves as the Equity Surplus Claims Department, assisting:

Former homeowners

Heirs

Estates

We provide:

Attorney-managed filings

Clerk-compliant documentation

Probate coordination

No upfront fees

Protecting Your Equity Early (Before It’s Taken)

Equity can be targeted by:

Third-party claimants

Predatory recovery companies

Fraudulent filings

We often advise homeowners to sign an equity claim against their own property early — as a means of protection.

Think of It Like This

Just as you can lock your credit with Experian to prevent fraud,

an equity claim can help lock in and protect your property’s equity.

Early action can prevent loss later.

Lis Pendens FAQs (People Also Ask)

Is a lis pendens public record in Florida?

Yes. Anyone can view it through county clerk records.

Does a lis pendens affect my credit?

Not directly, but the foreclosure may.

Can heirs inherit a property with a lis pendens?

Yes. The lis pendens follows the property.

Does a lis pendens mean eviction?

No. Occupancy usually changes only after sale.

Can multiple lis pendens exist on one property?

Yes, depending on disputes and claims.

Final Thoughts for Florida Homeowners

A lis pendens is serious — but it is also a moment of awareness, not a final outcome.

Whether your goal is to:

Stop foreclosure

Sell before auction

Preserve equity

Or recover surplus funds

Understanding your position early gives you the most control.

📧 Email us today. Call today.

claimfunds@visionarysurplusrecovery.com ☎ (813) 934-4146