Calhoun County Florida Surplus Funds – Official Homeowner Guide(Foreclosure Sales Only)

Introduction

If your property in Calhoun County, Florida was sold at a judicial foreclosure sale, you may be entitled to foreclosure surplus funds, also referred to as excess proceeds.

Under Florida Statute §45.032, when a foreclosure auction results in a sale price that exceeds the total amount owed on the mortgage, liens, judgments, interest, and court costs, the remaining balance becomes surplus funds. These funds belong to the former homeowner or other legally eligible claimants, not the bank or foreclosing plaintiff.

In Calhoun County, surplus funds are held in the court registry by the Calhoun County Clerk of Court & Comptroller and are released only after a verified claim is filed and approved, often requiring a court order authorizing disbursement.

Foreclosure Surplus vs. Tax Deed Surplus (Important)

Foreclosure surplus funds are not the same as tax deed surplus funds.

If you are searching for Calhoun County tax deed surplus funds, click here.

If your property was sold through a foreclosure sale, continue reading below.

How Surplus Funds Are Created in Calhoun County

Surplus funds in Calhoun County arise from judicial foreclosure sale proceeds, including:

Mortgage foreclosure sales

HOA foreclosure actions

Lien-based judicial foreclosures

When the final auction bid exceeds all sums due, the excess proceeds are deposited as funds held in the court registry, pending claim and disbursement subject to court order.

Step-by-Step: How to File a Surplus Funds Claim in Calhoun County

Where the Funds Are Held

Foreclosure surplus funds are maintained by the Calhoun County Clerk of Court & Comptroller, typically processed through the Civil Court Services Division / Foreclosure Department.

Required Claim Documentation

Most foreclosure surplus claims require:

Government-issued photo identification

Proof of ownership at the time of foreclosure

Any recorded assignments (if applicable)

Probate documents if the homeowner is deceased

Filing Deadlines

Florida law imposes strict statutory deadlines. Claims filed after the deadline may be permanently barred, even if funds remain in the registry.

Clerk Review Process

The Clerk reviews:

Claimant eligibility

Verified claim documentation

Compliance with Florida foreclosure surplus statutes

How Checks Are Issued

Upon approval, funds may be distributed via:

Court-issued check

Wire transfer

Zelle (when permitted by court policy)

Why Surplus Funds Claims Get Denied in Calhoun County

Common denial reasons include:

Incorrect or missing documentation

Probate not completed

Improper or unenforceable assignment agreements

Competing claims from heirs or lienholders

Filing after statutory deadlines

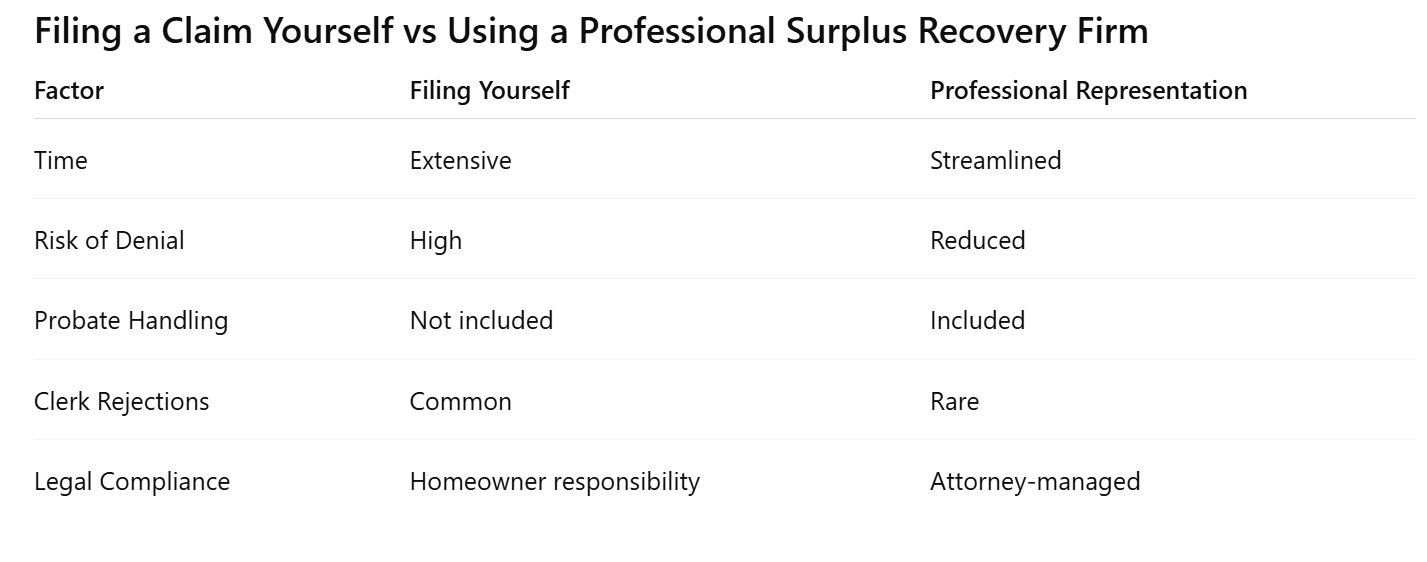

⚠️ Claims initially filed without professional representation that later require correction, amendment, or litigation may be subject to higher recovery fees due to the additional legal work required.

Probate & Heirs: What Happens If the Owner Is Deceased

If the former homeowner passed away before or after foreclosure:

Probate is typically required

Summary vs. formal administration depends on estate size and complexity

Counties will not release funds without proper legal authority

Court-appointed authority is mandatory before any disbursement.

Major Cities, Urban Areas & Neighborhoods in Calhoun County

Cities & Municipalities

Blountstown (county seat)

Altha

Communities & Rural Areas

Clarksville outskirts

Chipola River corridor properties

Agricultural and timberland subdivisions

Streets Commonly Appearing in Foreclosure Cases

Main Street

Central Avenue

Pear Street

River Street

County Road 20

County Road 73

Schools, Colleges & Medical Facilities

Blountstown High School

Altha Public School

Calhoun Liberty Hospital

Regional access to Tallahassee Memorial HealthCare

VA medical facilities serving Florida Panhandle veterans

Why Homeowners Choose Visionary Surplus Recovery

Calhoun County homeowners, heirs, and estates choose Visionary Surplus Recovery because claims are handled as a dedicated Equity Surplus Claims Department, not a mass filing service.

Homeowners work with us because:

Claims are attorney-managed

Filings are Clerk-compliant and court-ready

Probate is included when required

No upfront fees

Fewer denials and faster processing

Regular claim status updates

Full transparency using public records

End-of-claim distribution summary, detailing:

Total amount awarded by the court

Exact net proceeds issued to the claimant

Clients are also shown how to independently verify filings through public court records, ensuring trust and accountability.

Filing a Claim Yourself vs Using a Professional Firm

What Happens If You Do Nothing

If no valid claim is filed:

Funds may eventually escheat to the State of Florida

Lienholders may intervene

Claims become legally complex and costly

Pre-Foreclosure Help in Calhoun County (Sell Before Auction)

If your property is still in pre-foreclosure, you may have options to stop foreclosure, sell quickly, or protect your equity before auction.

Through Visionary Estates UPP LLC:

Sell your house fast in Calhoun County

Cash offers

As-is purchases

Closings in as little as 7 days

📞 Call David – Cash Acquisitions Manager

813-335-8082

📧 cashoffers@visionarysurplusrecovery.com

What Happens After You File a Claim

Clerk review timelines vary

Court approval may be required

Distribution issued by check, wire, or Zelle

Frequently Asked Questions About Surplus Funds in Calhoun County

How long does it take to receive surplus funds?

Typically 30–90 days after approval.

Does the bank receive the surplus?

No. Surplus funds belong to the former homeowner or eligible claimant.

Can I file a claim myself?

Yes, but filing errors commonly lead to delays or denial.

What if multiple heirs exist?

Probate and court authorization are required.

Are foreclosure surplus funds taxable?

Consult a tax professional regarding tax treatment.

Calhoun County Overview

For a statewide overview, review our Florida foreclosure surplus funds guide explaining how excess proceeds are handled across all counties.

Homeowners may also benefit from reviewing:

foreclosure surplus funds in Liberty County

Jackson County Clerk of Court surplus funds process

If your property has not yet gone to auction, explore how to stop foreclosure in Calhoun County or sell your home fast before foreclosure through our equity protection programs.

Take Action Now

Use our Free Surplus Eligibility Tool to determine whether foreclosure surplus funds are currently held in the Calhoun County court registry and receive a free county-specific evaluation today.