Citrus County Florida Surplus Funds – Official Homeowner Guide (Foreclosure Sales)

Foreclosure Surplus Funds in Citrus County, Florida

📧 intake@visionarysurplusrecovery.com

☎ (813) 859-6649 or text (813) 859-6649

When a property is sold at a judicial foreclosure sale in Citrus County, Florida, the final auction price may exceed the total amount owed on the mortgage, interest, court costs, and allowable fees. Any remaining balance after those obligations are satisfied is referred to as foreclosure surplus funds, also known as excess proceeds.

Under Florida Statute §45.032, foreclosure surplus funds do not belong to the bank, lender, or foreclosing plaintiff. These funds legally belong to the former homeowner or other eligible claimants, such as heirs, estates, or junior lienholders with valid standing.

In Citrus County, foreclosure surplus funds are typically held in the court registry and administered by the Citrus County Clerk of Court & Comptroller, Civil Court Services Division. Disbursement is subject to court order and requires properly filed, verified claim documentation.

Important distinction:

This guide applies only to foreclosure surplus funds resulting from mortgage, HOA, or lien foreclosures.

If you are searching for Citrus County tax deed surplus funds, you may click here to view the Citrus County Tax Deed Surplus Funds Guide.

If your funds resulted from a foreclosure sale, continue reading below.

How Surplus Funds Are Created in Citrus County

Surplus funds are generated when a foreclosure auction produces judicial foreclosure sale proceeds greater than the total judgment amount.

Mortgage Foreclosure Sales

When competitive bidding occurs at a Citrus County foreclosure auction and the final bid exceeds the lender’s judgment, surplus funds may be created.

HOA and Lien Foreclosures

HOA and condominium lien foreclosures frequently result in surplus funds because lien balances are often far lower than the property’s market value.

Once generated, all excess proceeds are deposited into the court registry, where they remain until released by court order.

Step-by-Step: How to File a Surplus Funds Claim in Citrus County

Where Foreclosure Surplus Funds Are Held

All foreclosure surplus funds are held by the Citrus County Clerk of Court & Comptroller in the court registry pending judicial authorization.

Required Claim Forms & Documentation

Most claims require:

A verified surplus funds claim or motion

Government-issued photo identification

Proof of ownership at the time of foreclosure

Recorded assignment agreements (if applicable)

Probate documentation if the owner is deceased

Filing Deadlines

Florida law imposes strict statutory deadlines. Claims filed outside those deadlines may be denied regardless of merit.

Clerk Review Process

The Clerk’s Office reviews:

Standing of the claimant

Completeness and accuracy of documentation

Competing claims, liens, or probate issues

Claims that fail to meet procedural requirements are often rejected without opportunity for correction.

How Funds Are Distributed

Once approved, funds may be released by:

Check issued pursuant to court order

Attorney trust account disbursement

Limited electronic transfer options, when authorized

Why Surplus Funds Claims Get Denied in Citrus County

Many surplus funds claims are denied due to avoidable filing errors, including:

Incorrect or missing documentation

Probate not completed or improperly filed

Improper assignment agreements

Competing claims or unresolved liens

Filing after statutory deadlines

⚠️ Important Notice

Claims initially filed without professional representation that later require correction, amendment, or litigation may be subject to modified recovery terms, including a higher recovery fee, due to the additional work required.

Probate & Heirs: What Happens If the Owner Is Deceased

When a former homeowner has passed away, Citrus County cannot release surplus funds without proper legal authority.

When Probate Is Required

Probate is commonly required when:

The owner died before surplus funds were distributed

Multiple heirs exist

Estate documentation has not been established

Summary vs Formal Administration

Summary Administration: Smaller or uncontested estates

Formal Administration: Larger estates or disputed claims

Without probate authority, funds remain frozen in the court registry.

Major Cities, Urban Areas & Neighborhoods in Citrus County

Major Cities & Municipalities

Inverness

Crystal River

Homosassa

Lecanto

High-Foreclosure ZIP Codes (Examples)

34450, 34452

34461, 34465

34446

Well-Known Neighborhoods & Communities

Sugarmill Woods

Citrus Hills

Black Diamond

Beverly Hills

Pine Ridge

Common Foreclosure Street Names

U.S. Highway 41

State Road 44

Citrus Avenue

Gulf to Lake Highway

Homosassa Trail

Major Schools, Colleges & Hospitals

College of Central Florida (Citrus Campus)

Citrus Memorial Health System

Seven Rivers Regional Medical Center

Bayfront Health Crystal River

James A. Haley Veterans’ Hospital (regional VA facility)

What Happens If You Do Nothing

If foreclosure surplus funds are not claimed:

Funds may eventually escheat to the State of Florida

Lienholders may intervene

Claims may become legally complex or contested

Failing to act can permanently affect recoverability.

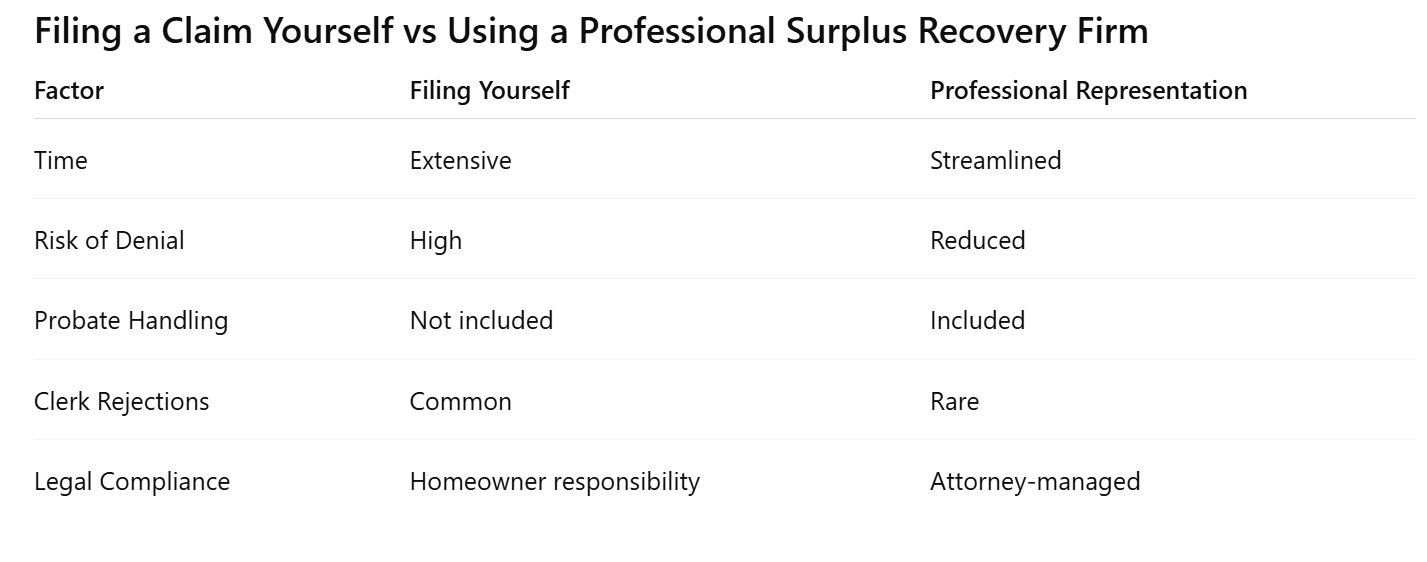

Filing a Claim Yourself vs Using a Professional Surplus Recovery Firm

Why Homeowners Choose Visionary Surplus Recovery

Visionary Surplus Recovery operates as the Equity Surplus Claims Department, assisting former homeowners, heirs, and estates with:

Attorney-managed surplus funds claims

Clerk-compliant documentation

Probate included when required

No upfront fees

Faster processing and fewer denials

We are not a government entity and do not guarantee outcomes.

Pre-Foreclosure Help in Citrus County (Before Auction)

If your property is still in pre-foreclosure, you may have options to protect your equity before auction.

Homeowners searching for:

stop foreclosure in Citrus County

pre-foreclosure help in Citrus County

sell my house fast before foreclosure

cash buyer before foreclosure

sell as-is in 7 days

May qualify for a direct cash offer through our affiliated equity protection programs.

Visionary Estates UPP LLC

Cash Acquisitions Manager: David

📞 Call 813-335-8082

Homes are purchased as-is, with flexible closings and no repairs required.

What Happens After You File a Claim

Clerk review (often 30–90 days)

Court approval, if required

Distribution by check or authorized transfer

Frequently Asked Questions About Surplus Funds in Citrus County

How long does it take to receive surplus funds?

Most claims are resolved within 30–120 days, depending on complexity.

Does the bank get the surplus?

No. Surplus funds belong to the former homeowner or eligible claimant.

Can I file the claim myself?

Yes, but filing errors commonly result in denial or delay.

What if multiple heirs exist?

Probate is usually required before funds can be released.

Are surplus funds taxable?

Surplus funds are generally not taxable income, but consult a tax professional.

Florida Foreclosure Surplus Funds Guide

Florida foreclosure surplus funds guide

statewide foreclosure surplus funds in Florida

Florida surplus funds recovery process

Surrounding Counties

foreclosure surplus funds in Hernando County

Pasco County Clerk of Court surplus funds

Levy County foreclosure surplus funds

Supporting High-Conversion Links

Equity Protection / Pre-Foreclosure Help

stop foreclosure in Citrus County

protect your home equity before foreclosure

check surplus funds eligibility

free foreclosure surplus funds search

surplus funds when the homeowner is deceased

Florida probate surplus funds process

Sell Your Home Fast (Visionary Estates UPP LLC)

sell your house fast in Citrus County

cash offer before foreclosure

Take Action Now

If your property was foreclosed in Citrus County, surplus funds may still be held in the court registry.

👉 Check surplus funds eligibility now

👉 Request a free Citrus County surplus evaluation