Clay County Florida Foreclosure Surplus Funds – Official Homeowner Guide

Prepared by Visionary Surplus Recovery LLC

Educational resource for former homeowners, heirs, and estates

Clay County Foreclosure Surplus Funds Overview

When a property in Clay County, Florida is sold at a judicial foreclosure sale for more than the total amount owed under the final judgment, the remaining balance is classified as foreclosure surplus funds, also referred to as excess proceeds.

Under Florida Statute §45.032, foreclosure surplus funds:

Belong to the former homeowner or legally eligible claimants

Are not retained by the lender

Are not automatically disbursed

Are typically held in the court registry

In Clay County, surplus funds are administered by the Clay County Clerk of Court & Comptroller and may only be released after the filing of a verified claim and, when required, a court order approving disbursement.

The Clerk of Court cannot provide legal advice or assist with claim preparation.

Foreclosure Surplus Funds vs Tax Deed Surplus Funds (Important)

Many homeowners search broadly for “Clay County surplus funds,” but Florida recognizes two separate surplus fund systems, each governed by different statutes and procedures.

Foreclosure Surplus Funds (This Guide)

Result from mortgage, HOA, or lien foreclosures

Governed by Florida Statute §45.032

Held in the court registry

Require a motion for disbursement

Often involve probate, liens, or competing claims

➡️ If you are searching for Clay County tax deed surplus funds, click here for the County Tax Deed Surplus Guide.

➡️ If your property was sold through a court foreclosure, continue reading below.

How Surplus Funds Are Created in Clay County

Foreclosure surplus funds are created when a property sells for more than the amount required to satisfy:

The final judgment

Accrued interest

Attorney fees

Court costs

Statutory charges

Common Clay County Foreclosure Types

Residential mortgage foreclosures

HOA and condominium association foreclosures

Junior lien foreclosures

Investment property foreclosures

In growing markets such as Orange Park, Fleming Island, and Green Cove Springs, competitive foreclosure sales often generate excess proceeds.

Step-by-Step: How to File a Surplus Funds Claim in Clay County

Recovering surplus funds requires strict compliance with Clerk and court procedures.

Step 1: Confirm Funds Are Held

After the foreclosure sale, the Clerk audits the proceeds. If surplus exists, the file may reflect language such as:

“Funds held in the court registry pending disbursement subject to court order.”

Step 2: Determine Eligibility

Eligible claimants may include:

Former homeowners

Heirs or estates

Court-appointed personal representatives

Junior lienholders (by priority)

Step 3: Prepare Required Documentation

Common filings include:

Motion for Disbursement of Surplus Funds

Government-issued identification

Proof of ownership

Assignments (if applicable)

Probate documents (if owner is deceased)

Affidavits required by the Clerk

Step 4: File With the Clay County Clerk of Court & Comptroller

Claims are processed through:

Civil Court Services Division

Foreclosure Department

The Clerk reviews for administrative completeness, not legal sufficiency.

Step 5: Judicial Review (If Required)

Certain cases require:

Court hearings

Judicial approval

Resolution of competing claims or liens

Step 6: Disbursement of Funds

Upon approval:

Funds are released by check, wire, or approved electronic method

Payable to the approved claimant or authorized representative

⏱️ Estimated timeline: 30–90+ days

⛔ Errors frequently cause delays or denials

Why Surplus Funds Claims Get Denied in Clay County

Claims are commonly denied due to:

Incorrect or missing documentation

Probate not completed

Improper or invalid assignment agreements

Competing claims or unresolved liens

Failure to meet statutory deadlines

Improper formatting or notarization

⚠️ Important Notice

Claims initially filed without professional representation that later require correction, amendment, or litigation may be subject to modified recovery terms, including a higher recovery fee, due to the additional work required.

Probate & Heirs: When the Homeowner Is Deceased

If the former homeowner is deceased, Clay County will not release surplus funds without proper probate authority.

Probate Is Typically Required When:

There is no surviving spouse with clear entitlement

Multiple heirs exist

Title was held individually

The estate was never administered

Probate Options

Summary Administration (smaller estates)

Formal Administration (larger or contested estates)

Without Letters of Administration or court authority, funds remain frozen in the court registry.

✔ Visionary Surplus Recovery handles probate as part of the claim process when required.

Major Cities, Urban Areas & Neighborhoods in Clay County

Cities & Municipalities

Orange Park

Green Cove Springs

Fleming Island

Keystone Heights

Middleburg

Penney Farms

High-Foreclosure Areas (Examples)

Middleburg

North Orange Park

Argyle Forest corridor

Doctors Lake area

Well-Known Neighborhoods & Communities

Fleming Island Plantation

Oakleaf Plantation

Doctors Inlet

Magnolia West

Branan Field

Lake Asbury

Common Foreclosure Street Corridors

Blanding Blvd

Kingsley Ave

Argyle Forest Blvd

College Drive

County Road 220

State Road 21

Major Institutions

St. Johns River State College

Clay County Courthouse

Orange Park Medical Center

Ascension St. Vincent’s Clay County

Camp Blanding Joint Training Center (Military)

What Happens If You Do Nothing

If no valid claim is filed:

Funds remain held in the court registry

Junior lienholders may intervene

Legal complexity increases over time

Funds may eventually escheat under Florida law

Delaying action reduces leverage and options.

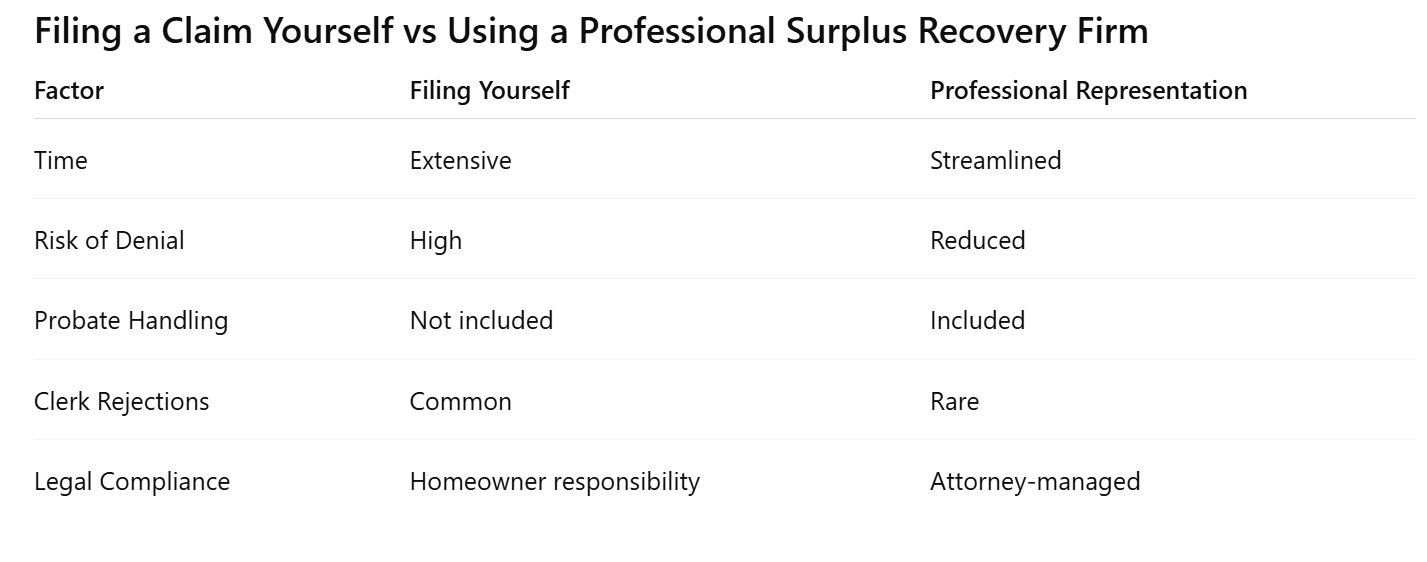

Filing a Claim Yourself vs Using Visionary Surplus Recovery

This comparison is informational and not legal advice.

Pre-Foreclosure Help in Clay County (Before Auction)

If your property has not yet gone to foreclosure sale, you may still have options to:

Stop foreclosure

Protect your equity

Sell your home fast as-is

Close in as little as 7 days

Through Visionary Estates UPP LLC, homeowners can receive direct cash offers with:

No repairs

No agent commissions

No closing costs

📞 Call David – Cash Acquisitions Manager

813-335-8082

Common searches we assist with:

“sell my house fast Clay County”

“cash buyer before foreclosure”

“stop foreclosure Orange Park”

“sell as-is before auction”

Why Homeowners Choose Visionary Surplus Recovery

Visionary Surplus Recovery serves as the Equity Surplus Claims Department, focused exclusively on Florida foreclosure surplus recovery.

✔ Attorney-managed claims

✔ Clerk-compliant filings

✔ Probate included

✔ No upfront fees

✔ Faster processing

✔ Fewer denials

✔ Secure disbursement

We are not a government entity and do not guarantee outcomes.

What Happens After You File a Claim

Clerk administrative review

Court approval (if required)

Disbursement authorization

Funds released to claimant

Frequently Asked Questions About Surplus Funds in Clay County

How long does it take to receive surplus funds?

Most claims resolve within 30–90+ days depending on complexity.

Does the bank get the surplus?

No. The lender receives only the amount owed under the judgment.

Can I file myself?

Yes, but errors frequently result in delays or denial.

What if multiple heirs exist?

Probate is usually required.

Are surplus funds taxable?

Consult a tax professional regarding your specific situation.

Check Your Clay County Surplus Funds Eligibility

✔ Free county-specific evaluation

✔ No upfront fees

✔ Attorney-managed claims

Clay County Page Links To:

Putnam County Clerk of Court surplus funds

Bradford County foreclosure surplus funds

St. Johns County foreclosure surplus funds

Key Notes & Conclusion

Homeowners may also benefit from reviewing the Florida foreclosure surplus funds guide, Clay County tax deed surplus funds, or neighboring county procedures such as foreclosure surplus funds in Duval County and Putnam County Clerk of Court surplus funds.

If your property has not yet gone to auction, explore ways to stop foreclosure in Clay County or sell your home fast before foreclosure through our equity protection programs.