Flagler County Florida Foreclosure Surplus Funds – Official Homeowner Guide

Foreclosure Surplus Funds Recovery for Former Homeowners, Heirs, and Estates in Flagler County, Florida

When a property is sold at a judicial foreclosure sale in Flagler County for more than the total amount owed on the mortgage, liens, and court costs, the remaining balance is known as foreclosure surplus funds, also referred to as excess proceeds.

Pursuant to Florida Statute §45.032, these surplus funds belong to the former homeowner or other legally eligible claimants — not the foreclosing lender or bank.

In Flagler County, foreclosure surplus funds are generally held in the court registry by the Flagler County Clerk of Court & Comptroller, where disbursement is subject to court order following submission of a verified surplus funds claim.

Important distinction

This page addresses foreclosure surplus funds only.

If you are searching for Flagler County tax deed surplus funds, you may click here for the county tax deed surplus guide.

If your property was sold at a mortgage foreclosure auction, continue reading below.

Visionary Surplus Recovery operates as the Equity Surplus Claims Department, assisting homeowners, heirs, and estates with attorney-managed, clerk-compliant filings — with no upfront fees.

How Surplus Funds Are Created in Flagler County

Surplus funds are created when a foreclosure auction results in a winning bid that exceeds:

The final judgment amount

Court costs and fees

Lien amounts adjudicated in the case

The remaining balance becomes judicial foreclosure sale proceeds and is deposited as funds held in the court registry.

Foreclosure Types Commonly Producing Surplus Funds

Residential mortgage foreclosures

HOA and condominium association foreclosures

Junior lien foreclosures

Step-by-Step: How to File a Surplus Funds Claim in Flagler County

The Flagler County Clerk of Court & Comptroller follows strict procedures for releasing foreclosure surplus funds.

1. Where Are Surplus Funds Held?

Surplus funds are maintained by the Flagler County Clerk of Court & Comptroller, typically through the Civil Court Services Division or Foreclosure Department.

2. Required Claim Documentation

Most claims require:

Government-issued photo identification

Proof of former ownership

Assignments (if applicable)

Probate documents if the owner is deceased

All submissions must include verified claim documentation.

3. Filing Deadlines

Claims must be filed within the statutory timelines set forth under Florida Statute §45.032. Late or incomplete filings are commonly denied.

4. Clerk Review & Court Approval

The Clerk reviews:

Claim validity

Competing claims or liens

Probate authority

Court compliance

All disbursements remain subject to court order.

5. How Funds Are Issued

Approved funds may be released by:

Court-issued check

Wire transfer

Zelle (where permitted)

Why Surplus Funds Claims Get Denied in Flagler County

Claims are frequently delayed or denied due to preventable issues, including:

Incorrect or missing documentation

Probate not completed

Improper or non-compliant assignment agreements

Competing creditor or lien claims

Filing after statutory deadlines

⚠️ Important Notice

Claims initially filed without professional representation that later require correction, amendment, or litigation may be subject to modified recovery terms, including higher recovery fees, due to the additional work required.

Probate & Heirs: What Happens If the Owner Is Deceased

If the former homeowner is deceased, probate is generally required before surplus funds can be released.

Probate Considerations

Summary vs. formal administration

Court-appointed personal representatives

Letters of Administration

Counties will not release surplus funds without proper legal authority.

Learn more in our Florida probate surplus funds process guide.

Major Cities, Urban Areas & Neighborhoods in Flagler County

Cities & Municipalities

Palm Coast

Bunnell (county seat)

Flagler Beach

High-Foreclosure Zip Areas

32164

32137

32110

Well-Known Neighborhoods

Palm Harbor

Indian Trails

Belle Terre

Pine Lakes

Common Foreclosure Street Names

Belle Terre Parkway

Palm Coast Parkway

Old Kings Road

Moody Boulevard

Schools, Colleges & Medical Facilities

Flagler Palm Coast High School

Matanzas High School

Flagler Hospital (regional)

North Florida VA medical facilities

What Happens If You Do Nothing

If surplus funds are not claimed:

Funds may eventually escheat

Lienholders may assert claims

Probate requirements increase

Recovery becomes legally complex

Surplus funds are not automatically distributed.

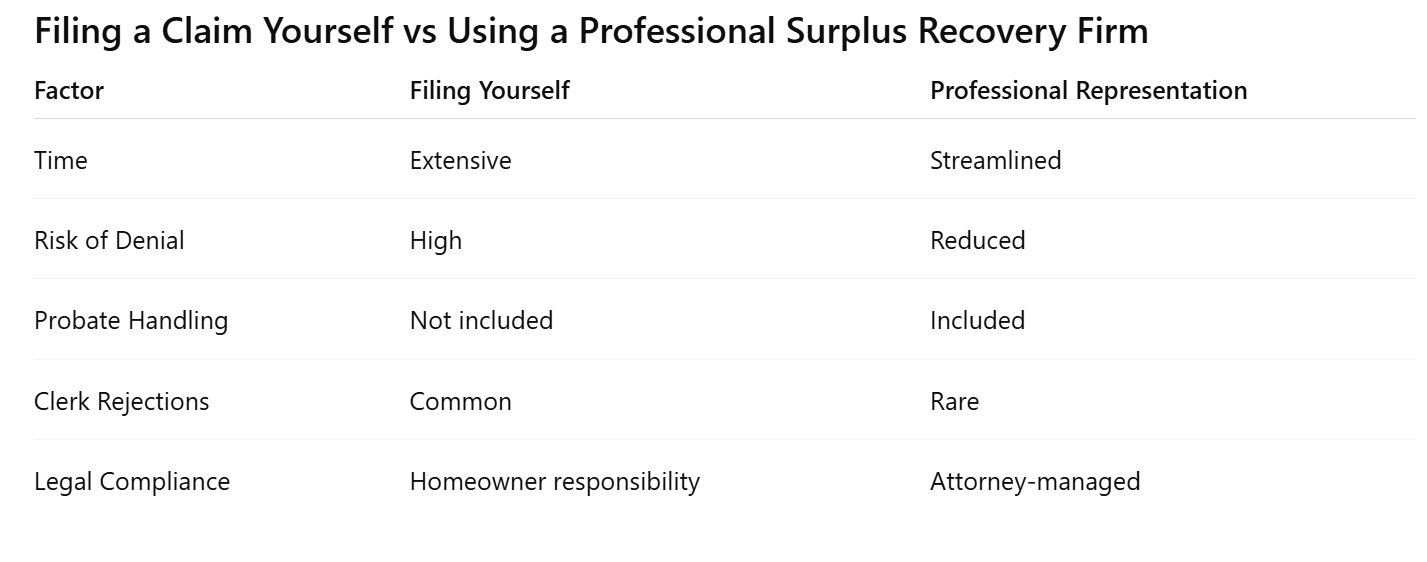

Filing a Claim Yourself vs Using a Professional Firm

Why Homeowners Choose Visionary Surplus Recovery

Homeowners work with Visionary Surplus Recovery as their Equity Surplus Claims Department because we provide:

Attorney-managed foreclosure surplus claims

Clerk-compliant filings

Probate included

No upfront fees

Faster processing and fewer denials

Pre-Foreclosure Help in Flagler County (Equity Protection)

If your property has not yet gone to foreclosure auction, you may still be able to:

Receive a cash offer before foreclosure

Sell as-is and close in as little as 7 days

Through Visionary Estates UPP LLC, homeowners can preserve equity before auction.

📞 Call David – Cash Acquisitions Manager

813-335-8082

What Happens After You File a Claim

Clerk review timelines vary

Court approval may be required

Funds are released after final authorization

Frequently Asked Questions About Surplus Funds in Flagler County

How long does it take to receive foreclosure surplus funds?

Typically several weeks to a few months depending on court approval.

Does the lender receive the surplus?

No. Excess proceeds belong to the former homeowner or eligible claimant.

Can I file the claim myself?

Yes, but errors frequently cause delays or denials.

What if multiple heirs exist?

Probate and court authorization are required.

Are surplus funds taxable?

Consult a qualified tax professional.

Flagler County Homeowner Resources

Homeowners may also benefit from reviewing the Florida foreclosure surplus funds guide, neighboring county procedures such as foreclosure surplus funds in Volusia County, St. Johns County Clerk of Court surplus funds, or Putnam County foreclosure surplus funds.

If your property has not yet gone to auction, explore options to stop foreclosure in Flagler County, sell your home fast before foreclosure, or check surplus funds eligibility to determine whether funds are currently held in the court registry.

Ready to Recover Your Foreclosure Surplus Funds?

Use our Free Surplus Eligibility Tool for a county-specific evaluation and determine whether foreclosure surplus funds are being held on your behalf in Flagler County, Florida.