Hardee County Florida Foreclosure Surplus Funds – Official Homeowner Guide

Foreclosure Surplus Funds in Hardee County, Florida

📧 intake@visionarysurplusrecovery.com

☎ (813) 859-6649 or text (813) 859-6649

Under Florida Statute §45.032, surplus funds—also known as excess proceeds from a foreclosure sale—are created when a judicial foreclosure auction results in a sale price that exceeds the total amount owed under the final judgment, including principal, interest, court costs, and authorized fees.

In Hardee County, Florida, these foreclosure surplus funds do not belong to the bank, mortgage servicer, HOA, or foreclosure sale purchaser. By law, surplus funds belong to the former homeowner or another eligible claimant, such as heirs, estates, or parties holding valid, court-recognized assignments.

After the foreclosure sale concludes, surplus funds are deposited into the court registry and are held by the Hardee County Clerk of Court & Comptroller. Funds are not released automatically. Disbursement is subject to court order and requires a verified surplus funds claim that complies with clerk and statutory requirements.

This guide explains how foreclosure surplus funds work in Hardee County, how to file a claim, why claims are denied, how probate impacts eligibility, and why many homeowners rely on the Equity Surplus Claims Department at Visionary Surplus Recovery.

How Surplus Funds Are Created in Hardee County

Foreclosure surplus funds in Hardee County are commonly generated through the following proceedings:

Judicial Mortgage Foreclosure Sales

When a property sells at public auction for more than the final foreclosure judgment amount, the remaining balance becomes judicial foreclosure sale proceeds held in the court registry.

HOA, Condo & Lien Foreclosures

Homeowners’ associations, condominium associations, and lienholders may foreclose for unpaid assessments. If the sale price exceeds the lien amount, excess proceeds are created.

Court Registry Handling

All surplus funds are classified as funds held in the court registry, with disbursement subject to court order following review by the Clerk and, when required, the court.

Step-by-Step: How to File a Surplus Funds Claim in Hardee County

Filing a foreclosure surplus funds claim in Hardee County requires careful attention to documentation and procedure.

1. Identify Where the Funds Are Held

Surplus funds are maintained by the Hardee County Clerk of Court & Comptroller, typically processed through the Civil Court Services Division or Foreclosure Department.

2. Prepare Required Claim Documentation

Claimants must submit verified claim documentation, which commonly includes:

Government-issued photo identification

Proof of former ownership (recorded deed or judgment)

Foreclosure case number

Final judgment and certificate of sale

Assignment agreements (if applicable)

Probate documentation (if the owner is deceased)

Incomplete or inconsistent documentation is a leading cause of denial.

3. Probate & Authority Review

If the former homeowner is deceased, the Clerk cannot release funds without valid probate authority or a court-appointed personal representative.

4. Filing Deadlines

Surplus funds claims are governed by statutory deadlines. Claims filed late may lose priority or require additional litigation.

5. Clerk Review & Judicial Approval

Claims are reviewed for compliance. Many claims require judicial approval before funds are released.

6. Disbursement of Funds

Upon approval, funds may be distributed via:

Court-issued check

Wire transfer

Zelle (when permitted)

All distributions remain subject to court order.

Why Surplus Funds Claims Get Denied in Hardee County

The Hardee County Clerk of Court routinely denies or delays claims due to:

Missing or incorrect documentation

Probate not opened or completed

Improper or unenforceable assignment agreements

Competing claims from heirs or lienholders

Filing after statutory deadlines

Lack of legal authority

⚠️ Important Notice

Claims initially filed without professional representation that later require correction, amendment, or litigation may be subject to modified recovery terms, including a higher recovery fee, due to the additional work required.

Probate & Heirs: What Happens If the Owner Is Deceased

If the former homeowner has passed away:

Probate is often mandatory

Summary vs. formal administration depends on estate value

Multiple heirs require court determination

Counties will not disburse surplus funds without proper authority

Probate-related issues are one of the most common reasons surplus funds remain unclaimed in Hardee County.

Major Cities, Urban Areas & Neighborhoods in Hardee County

Cities & Municipalities

Wauchula

Bowling Green

Zolfo Springs

Common High-Foreclosure ZIP Codes

33873, 33834, 33860

Neighborhoods & Communities

Peace River Estates

Little Charlie Creek area

Pioneer Park vicinity

Example Streets Commonly Appearing in Foreclosure Filings

US Highway 17

State Road 62

State Road 64

6th Avenue West

Palmetto Street

Major Institutions & Landmarks

Hardee Memorial Hospital

Wauchula Elementary & Middle Schools

Hardee Senior High School

Pioneer Park

Peace River corridor

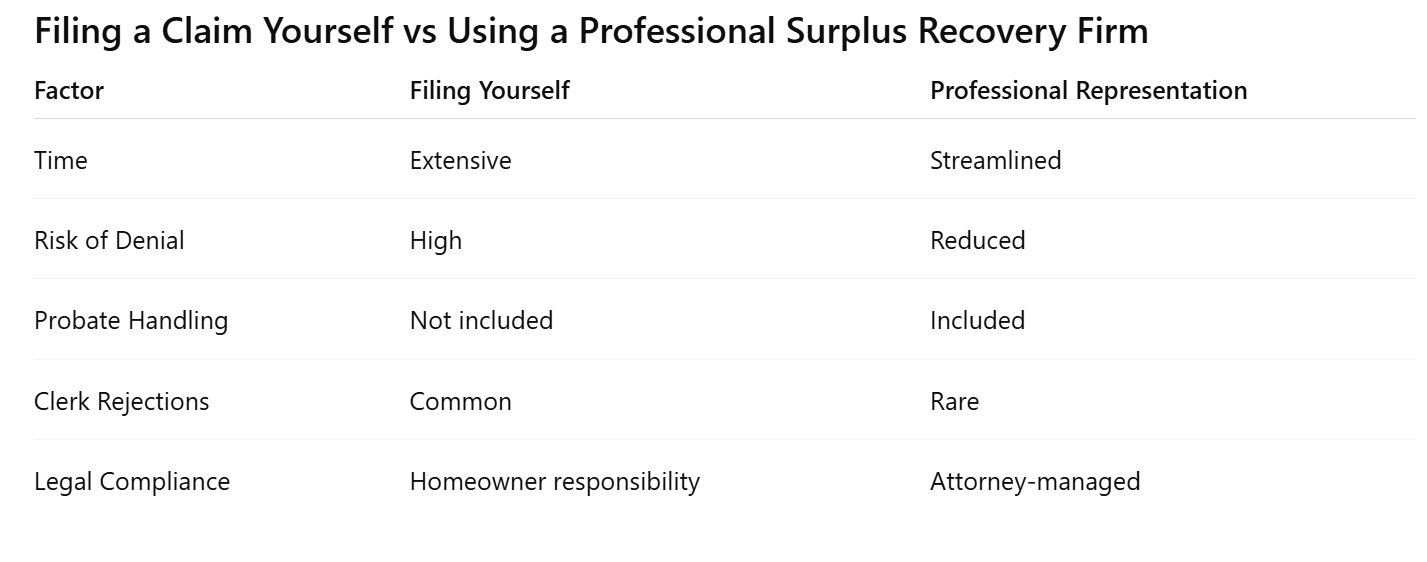

Filing a Claim Yourself vs. Using a Professional Surplus Recovery Firm

What Happens If You Do Nothing

Failing to act may result in:

Funds eventually escheating

Lienholders intervening

Increased legal complexity

Loss of priority rights

Surplus funds are not preserved indefinitely without action.

Pre-Foreclosure Help in Hardee County (Before Auction)

If your property is still in pre-foreclosure, options may exist to:

Stop foreclosure proceedings

Protect your remaining equity

Sell your home as-is

Close in as little as 7 days

You may receive a direct cash offer from Visionary Estates UPP LLC, our official distressed-property partner.

📞 Contact:

David – Cash Acquisitions Manager

813-335-8082

Common searches we help with:

sell my house fast Hardee County,

cash buyer before foreclosure,

avoid foreclosure auction,

sell as-is before foreclosure.

Why Homeowners Choose Visionary Surplus Recovery

Visionary Surplus Recovery operates as the Equity Surplus Claims Department, providing:

Attorney-managed surplus claims

Clerk-compliant documentation

Probate handled internally

No upfront fees

Faster, cleaner approvals

We are not a government agency and do not guarantee outcomes.

What Happens After You File a Claim

Clerk review (often 30–90 days)

Court approval when required

Funds disbursed upon court order

Timelines vary depending on claim complexity.

Frequently Asked Questions About Surplus Funds in Hardee County

How long does it take to receive surplus funds?

Most approved claims are paid within 30–90 days.

Does the bank receive the surplus?

No. Surplus funds belong to the former homeowner or eligible claimant.

Can I file the claim myself?

Yes, but errors frequently result in delays or denials.

What if multiple heirs exist?

Probate and court determination are required.

Are surplus funds taxable?

Consult a qualified tax professional.

Take Action!

✅ Free Hardee County Surplus Evaluation

✅ Attorney-Managed Claim Review

Hardee County Homeowner Resources

Conclusion

Homeowners may also benefit from reviewing the Florida foreclosure surplus funds guide, or nearby county procedures such as foreclosure surplus funds in Polk County, Highlands County Clerk of Court surplus funds, and DeSoto County foreclosure surplus funds.

If your property has not yet gone to auction, explore ways to stop foreclosure in Hardee County or sell your home fast before foreclosure through our equity protection programs.