Hendry County Florida Surplus Funds – Official Homeowner Guide (Foreclosure Sales Only)

Introduction

If your home or property in Hendry County, Florida was sold at a judicial foreclosure sale, you may be legally entitled to foreclosure surplus funds, also known as excess proceeds from a foreclosure sale.

Under Florida Statute §45.032, when a foreclosure auction produces a sale price greater than the total amount owed on the final judgment—including principal, interest, attorney fees, liens, and court costs—the remaining balance becomes surplus funds. These funds do not belong to the bank, lender, HOA, or county. They belong to the former homeowner or other legally eligible claimants.

In Hendry County, foreclosure surplus funds are funds held in the court registry and administered by the Hendry County Clerk of the Circuit Court & Comptroller. Release of these funds requires proper filing, verification, and court approval.

Foreclosure Surplus Funds vs. Tax Deed Surplus Funds

These are two completely different legal processes:

Foreclosure surplus funds come from judicial foreclosure sales and are governed by §45.032.

Tax deed surplus funds arise from tax deed sales and follow a separate statutory framework.

If you are searching for Hendry County tax deed surplus funds, that is a different process.

This guide applies only to foreclosure surplus funds in Hendry County.

How Surplus Funds Are Created in Hendry County

Surplus funds are created when judicial foreclosure sale proceeds exceed the final judgment amount entered by the court.

This commonly occurs through:

Foreclosure Sales

Mortgage lender foreclosures

Court-ordered judicial foreclosure actions

HOA and Lien Foreclosures

Condominium association foreclosures

HOA lien foreclosures

Judgment lien enforcement

Once surplus exists, funds are deposited into the court registry and remain there until a valid claim is approved.

Step-by-Step: How to File a Surplus Funds Claim in Hendry County

Where Surplus Funds Are Held

Foreclosure surplus funds are maintained by the Hendry County Clerk of the Circuit Court & Comptroller, typically through the Civil / Foreclosure Division.

Required Claim Forms & Documentation

A complete foreclosure surplus claim usually requires:

Government-issued photo ID

Proof of ownership at the time of foreclosure

Recorded assignments (if applicable)

Probate documentation when the owner is deceased

All submissions must comply with clerk verification standards.

Filing Deadlines

Florida law imposes strict statutory deadlines. Claims filed outside the allowable window may be denied—even if funds remain in the registry.

Clerk Review Process

The Clerk reviews:

Claimant eligibility

Completeness and accuracy of documentation

Statutory compliance

Certain claims require judicial review and a court order before funds can be released.

How Funds Are Issued

Approved surplus funds may be disbursed by:

Court-issued check

Wire transfer

Zelle (when permitted by the court)

Why Surplus Funds Claims Get Denied in Hendry County

Common reasons for denial or delay include:

Missing or incorrect documentation

Probate not opened or improperly completed

Non-compliant assignment agreements

Multiple competing claims

Failure to meet statutory deadlines

⚠️ Claims that are initially filed incorrectly and later require correction, amendment, or litigation often involve higher recovery fees due to increased legal complexity.

Probate & Heirs: What Happens If the Owner Is Deceased

If the former homeowner is deceased:

Probate is typically required

Summary vs. formal administration depends on estate size and heirs

The Clerk cannot release funds without proper court authority

The Hendry County Clerk of the Circuit Court & Comptroller cannot waive probate requirements.

Major Cities, Rural Areas & Communities in Hendry County

Cities & Census-Designated Areas

LaBelle

Clewiston

Montura Ranch Estates

Rural & Agricultural Areas

Felda

Pioneer Plantation

Port LaBelle

Hookers Point

Common Zip Codes

33935

33936

33944

33440

Streets Commonly Appearing in Foreclosure Filings

State Road 80

Cowboy Way

Captain Hendry Drive

Bridge Street

Harlem Academy Avenue

Birchwood Parkway

Schools & Medical Facilities

LaBelle High School

Clewiston High School

West Glades School

Hendry Regional Medical Center

Why Homeowners Choose Visionary Surplus Recovery

Former homeowners and heirs in Hendry County work with Visionary Surplus Recovery because claims are handled as a complete equity recovery process, not just form submission.

Our process includes:

Attorney-managed foreclosure surplus claims

Clerk-compliant filings

Probate coordination when required

No upfront fees

Faster processing with fewer denials

Clients receive:

Consistent claim status updates

Full transparency

A final distribution summary detailing:

Court-awarded surplus amount

Exact net disbursement

Clients are also shown how to independently verify public records through official county systems.

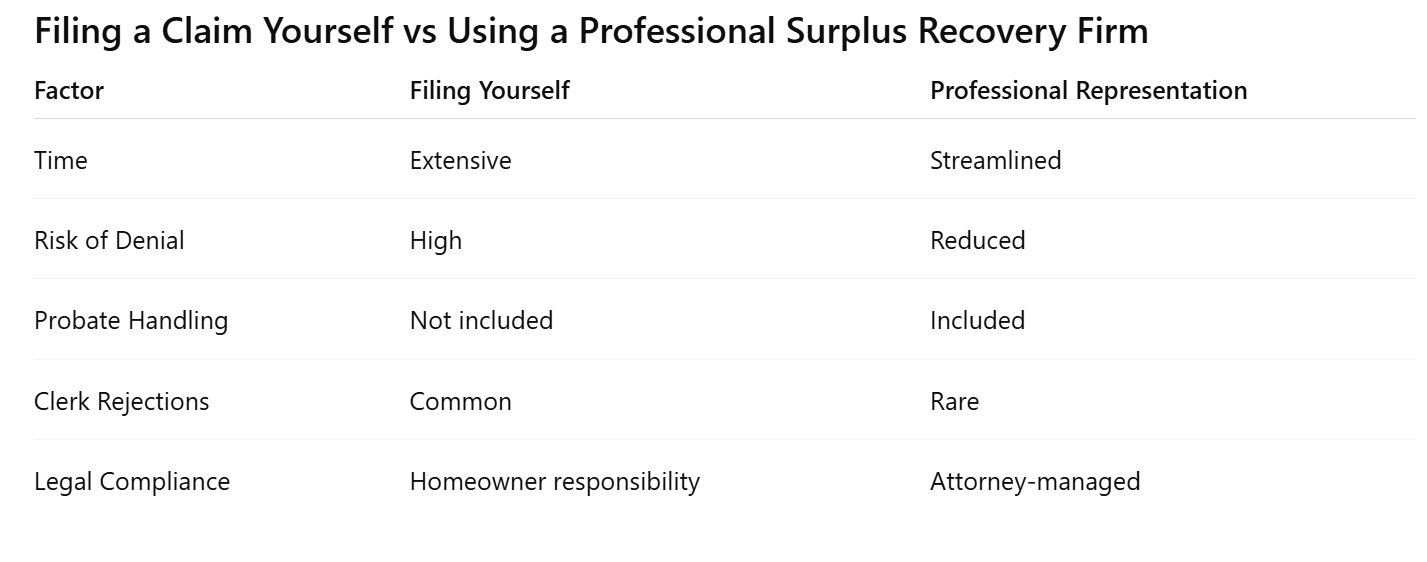

Filing a Claim Yourself vs Using a Professional Recovery Firm

What Happens If You Do Nothing

If no claim is filed:

Funds may escheat to the State of Florida

Lienholders may intervene

Recovery becomes more difficult and costly over time

Pre-Foreclosure Help in Hendry County (Sell Before Auction)

If your property is still in pre-foreclosure, you may be able to protect your equity before the foreclosure sale.

Through Visionary Estates UPP LLC, homeowners may:

Sell a house fast in Hendry County

Receive cash offers

Sell as-is

Close in as little as 7 days

📞 Call David – Cash Acquisitions Manager

813-335-8082

📧 cashoffers@visionarysurplusrecovery.com

What Happens After You File a Claim

Clerk review timelines vary

Court approval may be required

Funds are distributed by check, wire, or Zelle

Frequently Asked Questions About Surplus Funds in Hendry County

How long does it take to receive surplus funds?

Typically 30–90 days after court approval.

Does the bank or HOA receive the surplus?

No. Surplus belongs to the former owner or eligible claimant.

Can I file a claim myself?

Yes, but mistakes frequently cause delays or denials.

What if multiple heirs exist?

Probate and court authorization are required.

Are surplus funds taxable?

Consult a qualified tax professional.

Hendry County Keynotes & Links

For a statewide overview, review our Florida foreclosure surplus funds guide explaining how foreclosure surplus funds in Florida are handled.

You may also review nearby county processes such as:

Charlotte County foreclosure surplus funds

Lee County foreclosure surplus procedures

Collier County foreclosure surplus funds

If your property has not yet gone to auction, explore options to stop foreclosure in Hendry County, access pre-foreclosure help, or sell your home fast before foreclosure through our equity protection programs.

You may also check surplus funds eligibility using our free foreclosure surplus funds search to determine whether funds are currently held in the court registry.

Take Action Now

Use our Free Surplus Eligibility Tool to receive a free Hendry County foreclosure surplus funds evaluation and determine whether excess proceeds are currently being held by the court.