Seminole County Tax Deed Surplus Funds (Florida Guide)

📧 intake@visionarysurplusrecovery.com

☎ (813) 859-6649 or text (813) 859-6649

Click here to Start Your Claim

Helping Homeowners Recover Surplus Funds After a Tax Deed Sale

If your property in Seminole County, Florida was sold at a tax deed auction, you may still be entitled to surplus funds—the extra money left over after the county collects the delinquent taxes and associated costs. Many homeowners never claim these funds, even though the process is legally straightforward and the money is rightfully theirs.

This guide explains how tax deed surplus works in Seminole County, who qualifies, how the process unfolds, and how Visionary Surplus Recovery can assist you from start to finish.

The Equity Surplus Claims Department manages the entire process to minimize delays and prevent costly mistakes.

📧 intake@visionarysurplusrecovery.com

☎ (813) 859-6649 or text (813) 859-6649

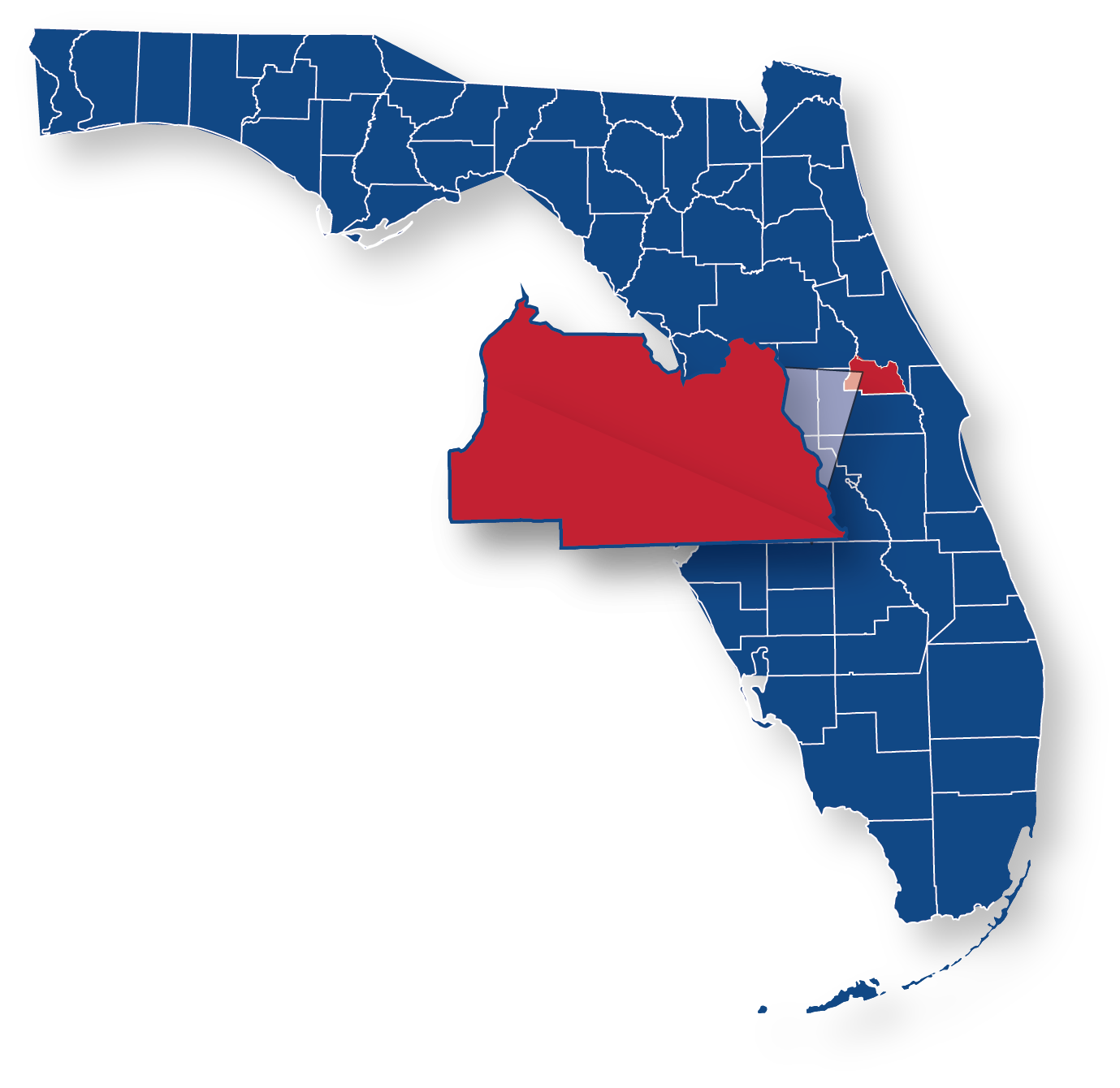

Seminole County Coverage Areas

This page applies to all communities within Seminole County, including:

Sanford

Altamonte Springs

Oviedo

Winter Springs

Lake Mary

Longwood

Casselberry

Heathrow

If the tax deed sale took place anywhere in Seminole County, this guide applies to you.

What Are Tax Deed Surplus Funds in Seminole County?

When a property is auctioned at a Seminole County tax deed sale, the winning bid often exceeds the amount owed in taxes.

The leftover balance is called surplus funds, and Florida law allows the former property owner—or their lawful heirs—to claim that money.

Example:

If $5,000 in back taxes were owed and the property sold for $72,000, the former owner may be entitled to $67,000 in surplus funds.

Who Can Claim Seminole County Tax Deed Surplus Funds?

Surplus funds can be claimed by:

1. The Former Property Owner

The person whose name was on the title at the time of the tax deed sale.

2. Heirs of a Deceased Property Owner

Florida law permits children, spouses, siblings, and other legal heirs to claim surplus funds.

3. Anyone With a Legal Interest in the Property

Examples include:

Court-appointed probate representatives

Guardians

Trustees of estates

Liens or judgments with legal priority

Other parties recognized by the court

📧 intake@visionarysurplusrecovery.com

☎ (813) 859-6649 or text (813) 859-6649

How the Seminole County Tax Deed Surplus Process Works

Step 1 — The Property Is Sold

Once the tax deed sale occurs, Seminole County calculates whether any surplus exists.

Step 2 — Surplus Funds Are Deposited Into the Registry

If the sale produces excess proceeds, the surplus is held by the Seminole County Clerk & Comptroller.

Step 3 — Eligible Parties Submit a Claim

A legally compliant claim packet must be filed with supporting documentation.

📧 intake@visionarysurplusrecovery.com

☎ (813) 859-6649 or text (813) 859-6649

Click here to Start Your Claim

Step 4 — A Judge Reviews the Claim

Surplus funds are only released after judicial approval.

Step 5 — Payment Is Disbursed

Once approved, funds are sent by check, wire, or other approved method.

Important: Errors in documentation, probate complications, or competing claims can delay or block your recovery.

How Visionary Surplus Recovery Helps Seminole County Homeowners

Most homeowners don’t realize how many issues can arise:

Missing documents

Incorrect claim forms

Probate complications

Competing claims from creditors

Difficulty proving ownership

Delays in court review

Visionary Surplus Recovery handles everything on behalf of the claimant.

We manage the entire process from start to finish, including:

Court filings

Probate when required

Attorney representation

Ownership verification

Claim preparation

Follow-up with the Clerk and Judge

This ensures your claim is filed properly, reducing delays and maximizing approval success.

Contact Visionary Surplus Recovery

If you believe you may be owed surplus funds from a Seminole County tax deed sale, we can help you confirm your eligibility and recover the funds owed to you.

📍 Visionary Surplus Recovery – Equity Claims Division

Serving all of Seminole County

📧 intake@visionarysurplusrecovery.com

☎ (813) 859-6649 or text (813) 859-6649

Return to the Master Page

👉 Florida Tax Deed Surplus Funds by County (Full 2025 Guide)