Tax Deed Sales vs. Foreclosure Auctions: What Homeowners Need to Know About Surplus Funds

Tax deed auctions and foreclosure auctions may look similar on the surface — both involve properties being sold at public auction — but they are very different legal processes with very different outcomes for homeowners, especially when it comes to surplus funds.

Understanding the difference can help you determine whether money may be owed to you after the sale.

1. Tax Deed Auctions (Unpaid Property Taxes)

A tax deed auction occurs when property taxes go unpaid and the government sells the property to recover those taxes.

What homeowners should know:

Triggered by delinquent property taxes

Conducted by the county (Tax Collector / Clerk)

Often moves faster than mortgage foreclosures

Property is sold to the highest bidder

If the sale price exceeds the taxes, interest, and costs, surplus funds may exist

Surplus funds are not automatically sent to the former owner

👉 Many former owners never realize a tax deed sale created surplus funds in their name.

2. Foreclosure Auctions (Unpaid Mortgage or HOA Debt)

A foreclosure auction happens after a lender or HOA completes the legal foreclosure process and the property is sold to satisfy the debt.

What homeowners should know:

Triggered by missed mortgage or HOA payments

In judicial foreclosure states like Florida, cases often take months or even years

The foreclosure must go through the court system

Property is sold at a court-ordered public auction

If the sale price is higher than the total debt, foreclosure surplus funds may be created

Funds are held by the Clerk of Court, not automatically released

👉 Foreclosure auctions are the most common source of large surplus funds, sometimes totaling tens of thousands of dollars.

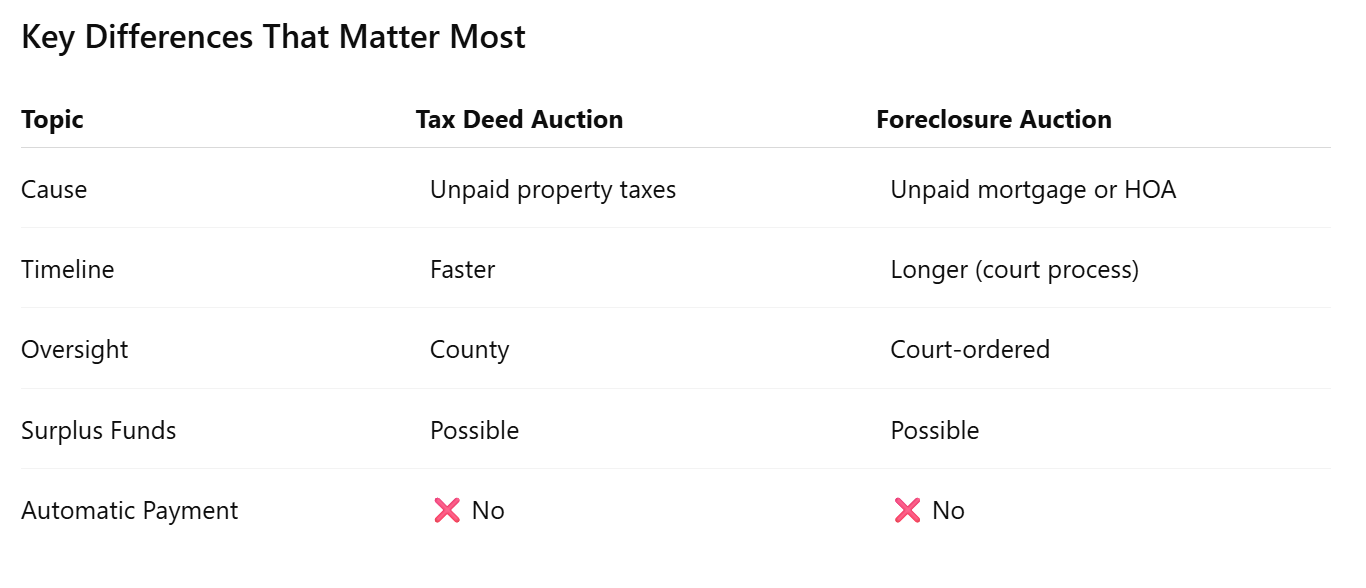

Key Differences That Matter Most

Why This Matters for Surplus Funds

In both tax deed and foreclosure auctions:

Surplus funds do not get mailed automatically

A formal claim must be filed correctly

Missed deadlines, paperwork errors, or legal complications can result in denial

Heirs, estates, and lienholders may need to be addressed

👉 Many homeowners lose their surplus simply because they didn’t know it existed or didn’t know how to claim it properly.

How Visionary Surplus Recovery Helps

Visionary Surplus Recovery specializes in helping homeowners, heirs, and estates identify and recover surplus funds from both tax deed sales and foreclosure auctions.

We:

Determine whether surplus funds exist

Identify the correct auction type and claim process

Prepare and file all required documentation

Resolve probate, heirship, and lien issues

Provide clear updates throughout the process

Only get paid if funds are successfully recovered

👉 If your property was sold at auction, there may still be money legally owed to you.

Email us today. Call today.

claimfunds@visionarysurplusrecovery.com ☎ (813) 934-4146

Knowing the difference between tax deed and foreclosure auctions can protect your rights — and help ensure you don’t leave money behind.