Tax Lien Foreclosure vs. Tax Deed Sale: What Homeowners Need to Know

When property taxes go unpaid, homeowners often hear the terms tax lien foreclosure and tax deed sale used interchangeably — but they are not the same thing, and the difference can directly affect property ownership and surplus fund rights.

Here’s a clear, homeowner-friendly breakdown.

What Is a Tax Lien Foreclosure?

A tax lien foreclosure happens when an investor who purchased a tax lien certificate takes legal action to foreclose on the property if the taxes remain unpaid.

How it works:

The county sells a tax lien certificate to an investor

The investor pays the delinquent taxes on your behalf

You still own the property during the redemption period

If the lien is not redeemed, the lienholder may initiate foreclosure

Ownership can transfer without a traditional public auction

Important to know:

Tax lien foreclosures are investor-driven

Surplus funds are uncommon in tax lien foreclosures

Outcomes vary widely by state law

👉 Many homeowners mistakenly believe tax lien foreclosures work the same as tax deed sales — they don’t.

What Is a Tax Deed Sale?

A tax deed sale occurs when property taxes remain unpaid long enough for the county to sell the property itself at a public auction.

How it works:

The county initiates the sale

The property is auctioned to the highest bidder

Taxes, interest, penalties, and costs are paid from the sale proceeds

If the winning bid exceeds what is owed, surplus funds may be created

Surplus funds are held by the Clerk of Court

👉 Tax deed sales are one of the most common sources of tax-related surplus funds.

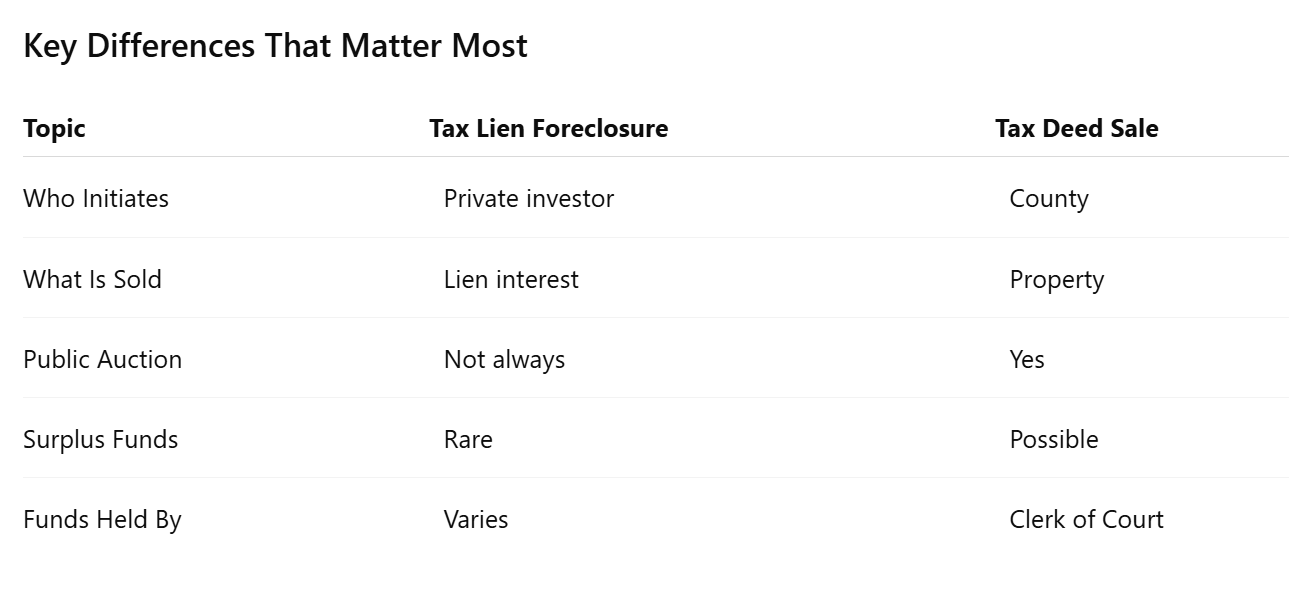

Key Differences That Matter Most

Why This Matters for Surplus Funds

Only tax deed sales typically generate surplus funds.

In cases where surplus exists:

Funds are not automatically paid

A formal claim must be filed

Deadlines, documentation, and ownership proof matter

Heirs, estates, or lienholders can complicate claims

👉 Many homeowners lose access to surplus funds simply because they don’t know the difference between these processes.

How Visionary Surplus Recovery Helps

Visionary Surplus Recovery helps homeowners, heirs, and estates determine:

Whether a tax deed sale occurred

Whether surplus funds exist

Who is legally entitled to claim them

How to file correctly with the Clerk of Court

We handle the paperwork, timelines, and legal coordination — and we only get paid if funds are successfully recovered.

👉 If your property was affected by unpaid taxes, there may still be money owed to you.

Email us today. Call today.

claimfunds@visionarysurplusrecovery.com ☎ (813) 934-4146

Understanding the difference between tax lien foreclosures and tax deed sales can protect your rights — and prevent you from leaving money behind.