Walton County Florida Foreclosure Surplus Funds Guide (Foreclosure Sales Only)

Walton County Florida Surplus Funds – Official Homeowner Guide

This guide explains how foreclosure surplus funds are created, held, and claimed in Walton County, Florida following a judicial foreclosure sale. It is written for former homeowners, heirs, estates, and court-appointed representatives seeking to recover excess proceeds from a foreclosure auction.

Important distinction:

This page covers foreclosure surplus funds only under Florida Statute §45.032.

If you are searching for Walton county-held tax deed surplus funds, you may click here.

If your funds resulted from a foreclosure sale, continue reading.

Foreclosure surplus funds in Walton County are generally held in the court registry by the Walton County Clerk of Court & Comptroller, Civil Court Services Division, and are released only upon verified claim and, when required, court order.

What Are Foreclosure Surplus Funds Under Florida Law?

Under Florida Statute §45.032, foreclosure surplus funds are created when a property sells at a judicial foreclosure auction for more than the total amount required to satisfy:

The foreclosing mortgage or lien

Court costs and fees

The final judgment amount

Any remaining balance is legally classified as surplus funds.

Key Legal Clarifications

Surplus funds belong to the former owner of record, not the lender

If the owner is deceased, funds may belong to eligible heirs or the estate

Lenders and servicers do not retain surplus proceeds

Funds remain held in the court registry until properly claimed

In Walton County, disbursement is administered through the Clerk of Court & Comptroller, subject to statutory and judicial requirements.

How Foreclosure Surplus Funds Are Created in Walton County

Foreclosure surplus funds may result from:

Judicial Foreclosure Sales

Court-ordered foreclosure auctions conducted pursuant to a final judgment entered by the court.

HOA and Lien Foreclosures

Judicial foreclosures initiated by homeowners’ associations or lienholders that result in excess sale proceeds.

Clerk-style language commonly applied:

“Judicial foreclosure sale proceeds are deposited into the court registry and remain subject to disbursement only upon verified claim documentation and, where applicable, court order.”

Step-by-Step: How to File a Foreclosure Surplus Funds Claim in Walton County

1. Confirm Where the Funds Are Held

Foreclosure surplus funds are typically maintained by:

Walton County Clerk of Court & Comptroller

Civil Court Services Division

Foreclosure Department

2. Assemble Required Claim Documentation

Most claims require:

Government-issued photo identification

Proof of ownership at the time of foreclosure

Case number, Final Judgment, and Certificate of Sale references

Assignment agreements (if applicable)

Probate or estate documents if the owner is deceased

3. Observe Filing Deadlines

Claims must be filed within statutory or court-ordered timeframes. Untimely filings are a common basis for denial.

4. Clerk Review Process

The Clerk reviews:

Claimant eligibility

Completeness and accuracy of documentation

Competing claims, liens, or court directives

Some claims may be processed administratively, while others require judicial review and approval.

5. Disbursement of Funds

Upon approval:

Funds may be released by check, wire transfer, or Zelle

Disbursement remains subject to court order when required

Why Foreclosure Surplus Funds Claims Get Denied in Walton County

Common reasons for denial include:

Missing or incorrect documentation

Failure to complete required probate

Invalid or non-compliant assignment agreements

Multiple competing claimants

Filing after statutory deadlines

Claims initially filed without professional representation that later require correction, amendment, or litigation may be subject to modified recovery terms due to the increased complexity and additional work required.

Probate & Heirs: What If the Homeowner Is Deceased?

When the former homeowner is deceased:

The Clerk cannot release surplus funds without legal authority

Probate is frequently required

Probate Administration Types

Summary Administration (when legally eligible)

Formal Administration (when required by statute or court order)

Without probate or a court-appointed personal representative, surplus funds remain held in the court registry indefinitely.

Major Cities, Urban Areas & Neighborhoods in Walton County

Cities & Municipalities

DeFuniak Springs

Santa Rosa Beach

Miramar Beach

Freeport

Paxton

Well-Known Communities & Corridors

Seaside

Rosemary Beach

Grayton Beach

Blue Mountain Beach

Inlet Beach

Point Washington

Common Foreclosure-Appearing Streets

U.S. Highway 98

County Highway 30A

Mack Bayou Road

East Hewett Road

Bay Drive

Landmarks & Institutions

Walton County Courthouse (DeFuniak Springs)

South Walton High School

Freeport High School

Emerald Coast Medical facilities

Veterans outpatient clinics serving South Walton

Why Walton County Homeowners Choose Visionary Surplus Recovery

Visionary Surplus Recovery operates exclusively as an Equity Surplus Claims Department, assisting former homeowners and estates with foreclosure surplus funds only.

Homeowners choose us because we provide:

Attorney-managed foreclosure surplus claims

Clerk-compliant documentation and filings

Probate coordination included when required

No upfront fees

Faster processing with fewer denials

Clients receive ongoing status updates, transparency throughout the process, and a final distribution summary clearly showing:

Total amount awarded by the court

Exact net proceeds disbursed

We also educate clients on how to independently verify public records, ensuring everything filed and represented can be confirmed directly with the Clerk.

What Happens After You File a Claim

Clerk review of verified claim documentation

Court approval if required

Disbursement from the court registry

Final distribution confirmation to the claimant

What Happens If You Do Nothing

If surplus funds are not claimed:

Funds may eventually escheat

Lienholders may attempt intervention

Claims often become more legally complex over time

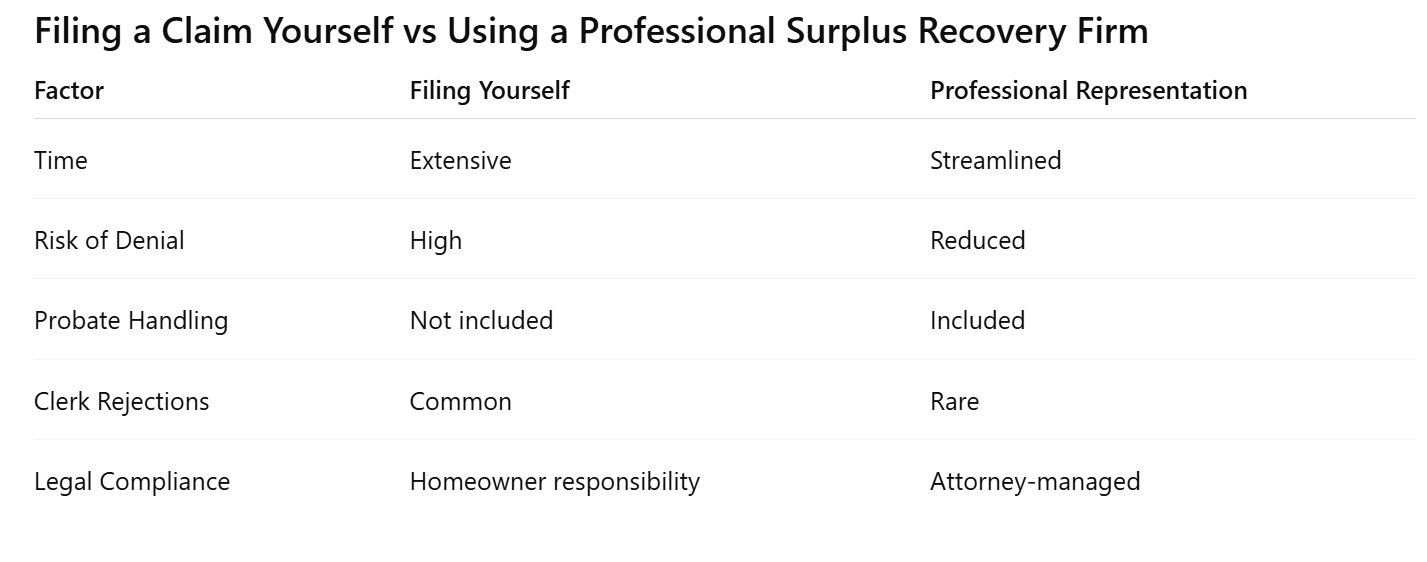

Filing a Claim Yourself vs Using a Professional Recovery Firm

No guarantees — only risk reduction and process control.

Pre-Foreclosure Help in Walton County (Before Auction)

If your property has not yet gone to foreclosure sale, options may still exist to:

Stop foreclosure

Sell your home fast

Preserve remaining equity

For homeowners seeking a cash sale before foreclosure, Visionary Estates UPP LLC may assist.

📞 Call David – Cash Acquisitions Manager: 813-335-8082

📧 Email: cashoffers@visionarysurplusrecovery.com

Homes may be purchased as-is, sometimes in under 7 days, depending on circumstances.

Frequently Asked Questions About Foreclosure Surplus Funds in Walton County

How long does it take to receive foreclosure surplus funds?

Timelines vary depending on Clerk review and whether court approval is required.

Does the lender receive the surplus?

No. Surplus funds belong to the former owner or eligible claimant.

Can I file the claim myself?

Yes, but filing errors frequently result in delays or denial.

What if multiple heirs exist?

Probate is generally required to establish authority and distribution.

Are foreclosure surplus funds taxable?

Consult a qualified tax professional for guidance.

Next Steps

✅ Request a free Walton County foreclosure surplus evaluation

✅ Confirm whether funds are currently held in the court registry

For a statewide overview, visit our Florida foreclosure surplus funds guide explaining how excess proceeds are handled across all counties.