Bradford County Florida Foreclosure Surplus Funds – Official Homeowner Guide

Introduction: Understanding Foreclosure Surplus Funds in Bradford County

📧 intake@visionarysurplusrecovery.com

☎ (813) 859-6649 or text (813) 859-6649

When a property is sold at a judicial foreclosure sale in Bradford County, Florida, the sale price may exceed the total amount owed on the mortgage, judgment, interest, and allowable costs. When this occurs, the remaining balance is known as foreclosure surplus funds, sometimes referred to as excess proceeds.

Under Florida Statute §45.032, these surplus funds do not belong to the bank, lender, or auction buyer. Instead, surplus funds are payable to the former homeowner or other legally eligible claimants, subject to proper filing and court approval.

In Bradford County, foreclosure surplus funds are typically held in the court registry by the Bradford County Clerk of Court & Comptroller, pending a verified claim and, when required, a court order authorizing disbursement.

Important distinction:

This page addresses Braford County foreclosure surplus funds arising from mortgage or lien foreclosures.

If you are searching for tax deed surplus funds, those are governed by a separate statutory process.

👉 If you are looking for Bradford County tax deed surplus funds, click here.

👉 If your property was sold through foreclosure, continue reading.

How Surplus Funds Are Created in Bradford County

Surplus funds are created when judicial foreclosure sale proceeds exceed all amounts due under the final judgment.

Common Sources of Surplus Funds

Mortgage foreclosure sales

HOA and condominium lien foreclosures

Judgment lien foreclosures

Court-ordered sales involving multiple lienholders

Once the foreclosure auction concludes and funds are paid, the Clerk applies the proceeds to satisfy:

The foreclosing plaintiff’s judgment

Court costs and fees

Subordinate lienholders (if applicable)

Any remaining balance becomes surplus funds held in the court registry, pending lawful disbursement.

Step-by-Step: How to File a Surplus Funds Claim in Bradford County

Filing a surplus funds claim is a formal legal process, not a simple request. Claims must comply with statutory requirements and Clerk procedures.

Step 1: Confirm Funds Are Being Held

Surplus funds are deposited with the Bradford County Clerk of Court & Comptroller, typically through the Civil Court Services Division or Foreclosure Department.

Step 2: Determine Eligibility

Eligible claimants may include:

Former property owners

Heirs or estates

Court-approved assignees

Lienholders (in limited circumstances)

Step 3: Prepare Required Documentation

Most claims require:

Government-issued photo ID

Proof of ownership at time of foreclosure

Recorded assignments (if applicable)

Probate documents (if owner is deceased)

Sworn claim forms or motions

All documentation must be verified, complete, and Clerk-compliant.

Step 4: File Within Statutory Deadlines

Failure to file within applicable deadlines may:

Result in claim denial

Allow other parties to intervene

Increase procedural complexity

Step 5: Clerk Review & Court Approval

The Clerk reviews filings for compliance.

Many disbursements are subject to court order, particularly when:

Multiple claims exist

Probate is required

Assignments are challenged

Step 6: Disbursement of Funds

Once approved, funds may be issued by:

Check

Wire transfer

Other authorized disbursement methods

Why Surplus Funds Claims Get Denied in Bradford County

Claims are denied more often than homeowners expect. Common reasons include:

❌ Incorrect or missing documentation

❌ Probate not completed or improperly filed

❌ Invalid or non-compliant assignment agreements

❌ Competing claims or unresolved liens

❌ Filing after statutory deadlines

Important Notice:

Claims initially filed without professional representation that later require correction, amendment, or litigation may be subject to modified recovery terms, including a higher recovery fee, due to the additional work required.

Probate & Heirs: What Happens If the Owner Is Deceased

When the former owner has passed away, surplus funds cannot be released without legal authority.

When Probate Is Required

Probate is typically required when:

The owner died before filing a claim

Multiple heirs exist

No surviving joint owner is listed

Probate Types

Summary Administration (simpler estates)

Formal Administration (larger or contested estates)

The county will not release funds without:

Court-appointed personal representative authority

Verified heirship documentation

Major Cities, Areas & Landmarks in Bradford County

Cities & Municipalities

Starke

Lawtey

Hampton

Common Foreclosure Zip Codes

32091

32058

32044

Neighborhoods & Communities

Downtown Starke

Kingsley Lake area

Rural residential subdivisions

HOA-managed communities

Courthouse Vicinity & Common Streets

North Temple Avenue

South Walnut Street

Call Street

Cherry Street

Schools, Colleges & Medical Facilities

Bradford High School

Southside Elementary School

North Florida College (regional proximity)

Shands at Starke (regional medical services)

Nearby VA medical facilities serving veterans

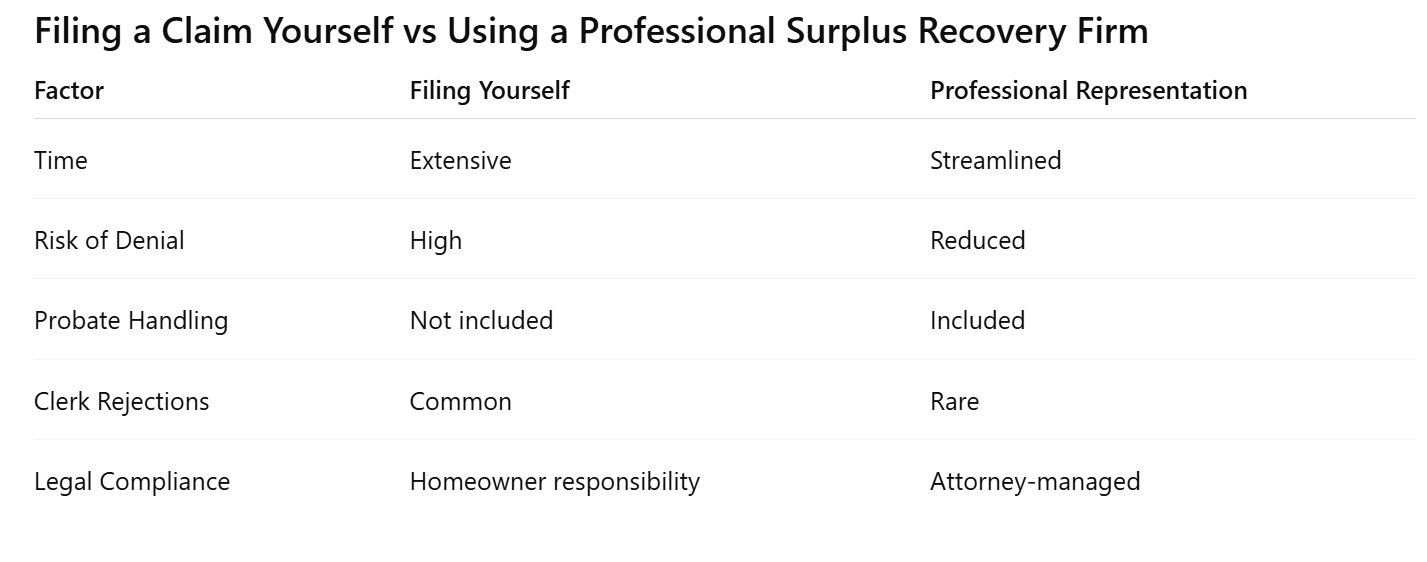

Filing a Claim Yourself vs Using a Professional Surplus Recovery Firm

This is not a guarantee of outcome — but a reflection of procedural realities.

What Happens If You Do Nothing

Failing to act can result in:

Funds eventually escheating to the State

Lienholders or third parties intervening

Increased legal complexity over time

Surplus funds are not automatically sent to former homeowners.

Why Homeowners Choose Visionary Surplus Recovery

Visionary Surplus Recovery operates as an Equity Surplus Claims Department, assisting homeowners, heirs, and estates with foreclosure surplus recovery.

Key Advantages

Attorney-managed claims

Clerk-compliant filings

Probate included when required

No upfront fees

Fewer delays and denials

Pre-Foreclosure Help in Bradford County (Before Auction)

If your home has not yet gone to foreclosure sale, surplus funds recovery may not be your best option yet.

Many Bradford County homeowners search for:

stop foreclosure in Bradford County

sell my house fast before foreclosure

cash buyer as-is under 7 days

Through Visionary Estates UPP LLC, homeowners may explore:

Selling as-is before auction

Choosing their closing date

Avoiding foreclosure entirely

📞 Call David – Cash Acquisitions Manager

813-335-8082

What Happens After You File a Claim

Clerk review of verified claim documentation

Court approval if required

Disbursement issued once authorized

Timelines vary depending on complexity and court involvement.

Frequently Asked Questions About Surplus Funds in Bradford County

How long does it take to receive surplus funds?

Processing times vary, but many claims take 30–90 days after approval.

Does the bank get the surplus?

No. Under Florida law, surplus funds belong to the former owner or eligible claimant.

Can I file myself?

Yes, but procedural errors commonly cause delays or denials.

What if multiple heirs exist?

Probate is typically required, and funds are distributed per court order.

Are surplus funds taxable?

Tax treatment varies. Consult a tax professional regarding your situation.

Take Action Now: Check Your Eligibility

If your Bradford County property was sold at foreclosure, surplus funds may still be held in the court registry.

👉 Check surplus funds eligibility

👉 Request a free Bradford County surplus evaluation

For a statewide overview, visit our Florida foreclosure surplus funds guide explaining how excess proceeds are handled across all counties.

Bradford County Homeowner Resources & Related Guides

Homeowners and heirs navigating foreclosure surplus funds in Bradford County often benefit from reviewing related statewide and county-specific resources.

For a broader understanding of how excess proceeds from judicial foreclosure sales are handled throughout the state, visit our Florida foreclosure surplus funds guide, which explains the statewide surplus recovery process and statutory framework.

You may also wish to review procedures in neighboring counties, including foreclosure surplus funds in Union County, Clay County Clerk of Court surplus funds, and Alachua County foreclosure surplus funds, as similar court registry and disbursement rules often apply.

Pre-Foreclosure & Equity Protection Resources

If your property has not yet gone to auction, you may still have options to protect your equity:

Learn how to stop foreclosure in Bradford County through early intervention strategies

Explore pre-foreclosure help in Bradford County to avoid auction entirely

Understand how to protect your home equity before foreclosure

Check Surplus Funds Eligibility

If a foreclosure sale has already occurred, you can check surplus funds eligibility to determine whether funds are currently held in the court registry and subject to disbursement.

Probate & Heirs Assistance

When the former homeowner is deceased, probate is often required before funds can be released. Review our guide on probate required for surplus funds, including the Florida probate surplus funds process and what heirs must file to obtain court approval.

Sell Your Home Fast Before Foreclosure

Homeowners facing imminent foreclosure may also consider selling before auction. Through our partner company, Visionary Estates UPP LLC, you can explore options to:

Sell your house fast in Bradford County

Receive a cash offer before foreclosure

Sell as-is without repairs or commissions