Brevard County Florida Foreclosure Surplus Funds Guide

📧 intake@visionarysurplusrecovery.com

☎ (813) 859-6649 or text (813) 859-6649

or fill out Intake Submission Ticket

Brevard County Foreclosure Surplus Funds Guide (Foreclosure Sales Only)

If your property in Brevard County, Florida was sold at a judicial foreclosure sale, you may be entitled to foreclosure surplus funds, also known as excess proceeds. These funds are often overlooked by former homeowners, heirs, and estates—despite being legally owed to them.

This guide is written for former property owners, heirs, and estates searching for how to claim foreclosure surplus funds in Brevard County. It explains how surplus funds are created, where they are held, how to file a claim correctly, and why claims are commonly denied.

Important distinction:

This page addresses foreclosure surplus funds only under Florida law.

If you are searching for Brevard county tax deed surplus funds, you can click here.

If you are pursuing foreclosure surplus funds in Brevard County, continue reading.

What Are Surplus Funds Under Florida Law (§45.032)

Under Florida Statute §45.032, surplus funds are created when a property is sold at a judicial foreclosure sale for more than the total amount owed on the mortgage, judgment, interest, attorney fees, and court costs.

Key Legal Points:

Surplus funds belong to the former property owner or eligible claimant

Banks, lenders, and foreclosing plaintiffs do not keep surplus funds

Funds are held in the court registry

Disbursement is subject to court order

Claims require verified documentation

In Brevard County, foreclosure surplus funds are administered by the Brevard County Clerk of Court & Comptroller, typically through the Civil Court / Foreclosure Department.

How Surplus Funds Are Created in Brevard County

Surplus funds arise from judicial foreclosure sales, including:

1. Mortgage Foreclosure Sales

When a lender forecloses and the auction sale price exceeds the final judgment amount.

2. HOA and Lien Foreclosures

Foreclosures initiated by:

Homeowners associations

Condominium associations

Judgment lienholders

In all cases, the excess amount remaining after payment of the judgment becomes foreclosure sale surplus funds.

Step-by-Step: How to File a Surplus Funds Claim in Brevard County

1. Where the Funds Are Held

Surplus funds are held in the court registry by the Brevard County Clerk of Court & Comptroller until a valid claim is approved.

2. Required Documentation

Claims generally require:

Government-issued photo ID

Proof of ownership at time of foreclosure

Recorded assignments (if applicable)

Probate documents (if the owner is deceased)

Verified claim documentation

3. Filing Deadlines

Florida law imposes strict statutory deadlines. Late filings risk:

Denial

Loss of priority

Transfer of funds to unclaimed property

4. Clerk Review Process

The Clerk reviews:

Claim validity

Competing claims

Lien priority

Probate authority

5. How Funds Are Issued

Once approved, disbursement is issued only after court authorization, typically by:

Check

Wire transfer

Zelle (when permitted)

Why Surplus Funds Claims Get Denied in Brevard County

Many foreclosure surplus funds claims fail due to avoidable errors, including:

❌ Incorrect or incomplete documentation

❌ Probate not completed when required

❌ Improper or invalid assignment agreements

❌ Competing lienholder claims

❌ Filing after statutory deadlines

Claims initially filed without professional oversight often require amendments, hearings, or litigation, increasing delays and complexity.

Probate & Heirs: What Happens If the Owner Is Deceased

If the former homeowner is deceased:

Summary vs. formal administration depends on circumstances

Counties will not release funds without proper authority

Heirs must establish legal standing before disbursement

This is one of the most common reasons foreclosure surplus funds remain unclaimed.

Major Cities, Urban Areas & Neighborhoods in Brevard County

Major Cities & Municipalities

Melbourne

Palm Bay

Titusville

Cocoa

Cocoa Beach

Rockledge

Satellite Beach

West Melbourne

Notable Neighborhoods & Areas

Suntree

Viera

Port St. John

Merritt Island

Indialantic

Indian Harbour Beach

Example Streets Common in Foreclosure Filings

Wickham Road

U.S. Highway 1

Palm Bay Road

Malabar Road

Babcock Street

Major Institutions

Eastern Florida State College

Holmes Regional Medical Center

Cape Canaveral Hospital

Patrick Space Force Base / VA-related services

Why Homeowners Choose Visionary Surplus Recovery

Visionary Surplus Recovery operates as the Equity Surplus Claims Department for Florida homeowners.

Homeowners choose us because we provide:

Attorney-managed claims

Clerk-compliant filings

Probate coordination included

No upfront fees

Faster processing with fewer denials

Regular claim updates

End-of-case distribution summaries

Education on how to verify public records independently

What Happens After You File a Claim

Typical timelines include:

Clerk review (varies by case complexity)

Court approval when required

Disbursement after order is entered

Payment methods may include check, wire, or Zelle, depending on court authorization.

What Happens If You Do Nothing

If surplus funds are not claimed:

Funds may eventually escheat

Lienholders may intervene

Claims become more legally complex over time

Waiting often reduces options.

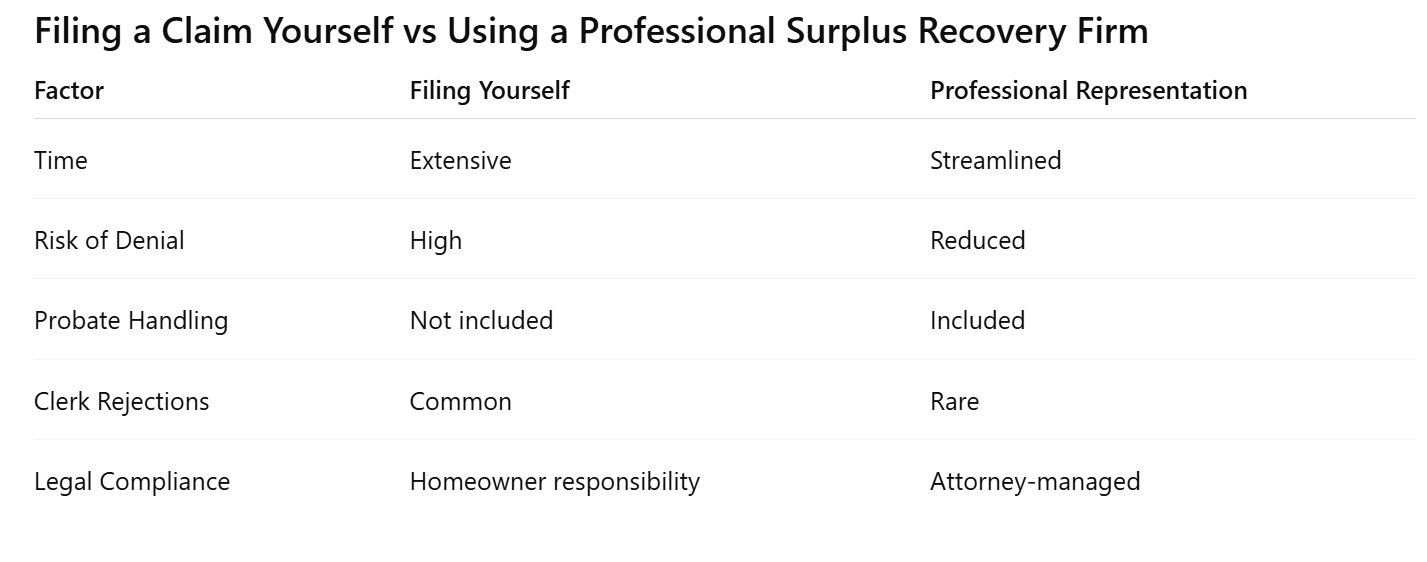

Filing Yourself vs. Using a Professional Surplus Recovery Firm

Pre-Foreclosure Help in Brevard County

If your property is still in pre-foreclosure, options may exist to:

Stop foreclosure

Protect equity

Sell the property as-is, often in under 7 days

Cash Sale Option (Pre-Foreclosure Only)

Visionary Estates UPP LLC assists homeowners who need to sell before foreclosure, not for surplus recovery.

📞 Call David – Cash Acquisitions Manager: 813-335-8082

📧 Email: cashoffers@visionarysurplusrecovery.com

Call to Action

You can check surplus funds eligibility now to determine whether funds are currently held in the court registry.

👉 Free Surplus Eligibility Tool

See if surplus funds exist

Confirm eligibility

Identify probate requirements

Get a county-specific evaluation

Frequently Asked Questions About Surplus Funds in Brevard County

How long does it take to receive surplus funds?

Timelines vary based on claim complexity and court review.

Does the bank get the surplus?

No. Surplus funds belong to the former owner or eligible claimant.

Can I file myself?

Yes, but errors frequently cause delays or denials.

What if multiple heirs exist?

Probate and court determination are usually required.

Are surplus funds taxable?

Tax treatment depends on individual circumstances.