Franklin County Florida Foreclosure Surplus Funds – Official Homeowner Guide

Franklin County Florida Foreclosure Surplus Funds Guide (Foreclosure Sales Only)

This long-form guide is written for former homeowners, heirs, estates, and authorized representatives searching for how to recover foreclosure surplus funds in Franklin County, Florida. It follows the same structure, formatting, and instructional flow used by the Franklin County Clerk of Court & Comptroller while remaining consumer‑friendly and educational.

Important distinction: This page covers foreclosure surplus funds only (judicial foreclosure sales under Florida Statute §45.032). If you are searching for tax deed surplus funds, visit our Franklin County Tax Deed Surplus Funds page. For foreclosure surplus funds in Franklin County, continue reading below.

What Are Foreclosure Surplus Funds in Franklin County?

Foreclosure surplus funds—also referred to as excess proceeds from a foreclosure sale—are created when a judicial foreclosure auction results in a sale price that exceeds the total amount owed on the final judgment, including principal, interest, attorney fees, and court costs.

Under Florida Statute §45.032, these excess funds:

Belong to the former homeowner or other legally entitled parties

Are not retained by the lender

Are typically held in the court registry

Are administered by the Franklin County Clerk of Court & Comptroller until properly claimed

The Clerk does not automatically release these funds. A verified claim, compliant documentation, and often a court order are required before any disbursement is issued.

How Foreclosure Surplus Funds Are Created in Franklin County

Surplus funds may be generated through several foreclosure-related processes in Franklin County, including:

Judicial Mortgage Foreclosure Sales

These are court‑ordered sales where a property is auctioned following a final judgment of foreclosure. If the winning bid exceeds the judgment amount, the difference becomes surplus funds.

HOA and Condominium Lien Foreclosures

Homeowners’ associations and condominium associations may foreclose on unpaid assessments. If the sale generates more than the lien amount, surplus funds may be created.

Multiple-Lien Scenarios

Properties with junior liens (HELOCs, judgment liens, code enforcement liens) can still produce surplus funds once lien priorities are resolved through the court.

In all cases, the judicial foreclosure sale proceeds are subject to court supervision and Clerk review before any funds are released.

Step‑by‑Step: How to File a Foreclosure Surplus Funds Claim in Franklin County

Filing a surplus funds claim in Franklin County is procedural and documentation‑heavy. Errors or omissions commonly result in delays or denials.

Step 1: Confirm Where the Funds Are Held

Foreclosure surplus funds are typically held by the Franklin County Clerk of Court & Comptroller, Civil Court Services Division, in the court registry.

Step 2: Identify the Proper Claimant

Eligible claimants may include:

The former property owner

Heirs or estates (if the owner is deceased)

Assignees with valid, compliant agreements

Lienholders (if legally entitled)

Step 3: Prepare Required Documentation

Most claims require:

Government‑issued identification

Proof of ownership at time of foreclosure

Verified claim documentation

Assignment agreements (if applicable)

Probate documents or Letters of Administration (if the owner is deceased)

Step 4: File the Claim With the Clerk

Claims must be filed within statutory deadlines and in compliance with Clerk formatting and filing requirements.

Step 5: Clerk Review and Court Approval

The Clerk reviews the filing for completeness. In many cases, disbursement is subject to court order, especially when competing claims or estates are involved.

Step 6: Distribution of Funds

Once approved, funds may be distributed by:

Check issued by the Clerk

Wire transfer (limited circumstances)

Zelle or electronic payment (when available)

Why Foreclosure Surplus Funds Claims Get Denied in Franklin County

Claims are frequently delayed or denied for reasons including:

Incorrect or missing documentation

Probate not completed or improperly filed

Invalid or non‑compliant assignment agreements

Competing claims or unresolved liens

Filing after statutory deadlines

Claims initially filed without professional representation that later require correction, amendment, or litigation may be subject to modified recovery terms, including higher recovery fees, due to the additional work required.

Probate & Heirs: When the Property Owner Is Deceased

If the former homeowner is deceased, Franklin County will not release surplus funds without proper legal authority.

When Probate Is Required

Probate is generally required when:

The owner died before or after the foreclosure sale

Multiple heirs exist

No survivorship deed applies

Summary vs. Formal Administration

Summary Administration may apply to smaller estates

Formal Administration is required for complex or contested estates

Without probate authority, surplus funds remain held in the court registry.

Major Cities, Communities & Local Areas in Franklin County

Franklin County foreclosure activity commonly appears across:

Cities & Municipalities

Apalachicola

Carrabelle

Eastpoint

High‑Foreclosure Zip Codes (General)

32320

32322

32328

Neighborhoods & Communities

St. George Island

Lanark Village

Magnolia Bluff

Alligator Point

Example Streets Frequently Appearing in Foreclosure Filings

U.S. Highway 98

Bluff Road

Market Street

Water Street

Oak Street

Community Anchors

Franklin County Courthouse area

George E. Weems Memorial Hospital

Apalachicola Bay Charter School

Why Franklin County Homeowners Choose Visionary Surplus Recovery

Visionary Surplus Recovery operates as the Equity Surplus Claims Department, assisting former homeowners and estates with attorney‑managed foreclosure surplus claims.

Homeowners choose us because we provide:

Attorney‑managed claims

Clerk‑compliant filings

Probate coordination included when required

No upfront fees

Faster processing with fewer denials

Clients are updated regularly, receive transparent status reports, and—at the conclusion of the claim—are provided a distribution summary showing:

The exact amount awarded by the county

Court‑approved fees

The net amount issued to the claimant

We also teach clients how to verify every step by reviewing public records directly with the Franklin County Clerk.

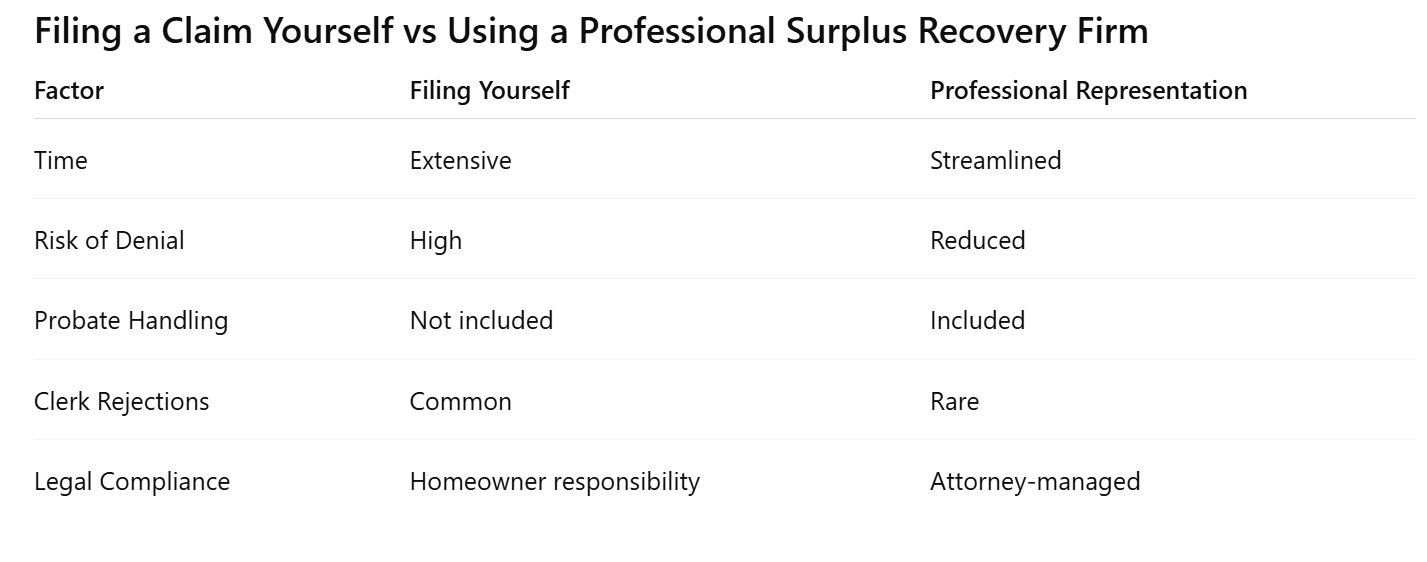

Filing a Claim Yourself vs Using a Professional Recovery Firm

This comparison is informational—not a requirement—but reflects common outcomes observed in Franklin County filings.

What Happens If You Do Nothing?

If surplus funds are not claimed:

Funds may eventually escheat

Lienholders may intervene

Claims can become legally complex

Early action preserves options and simplifies recovery.

What Happens After You File a Claim

Clerk review timelines vary by case complexity

Court approval may be required

Funds are distributed upon final authorization

Pre‑Foreclosure Help in Franklin County (Important)

If your property has not yet gone to foreclosure auction, surplus recovery may not be your best option.

Many Franklin County homeowners search for:

stop foreclosure in Franklin County

sell your home fast in Franklin County

cash offer before foreclosure

sell as‑is under 7 days

For homeowners seeking to sell before auction, Visionary Estates UPP LLC (cash acquisitions only) may be an option.

📞 Contact David – Cash Acquisitions Manager

Phone: 813‑335‑8082

Email: cashoffers@visionarysurplusrecovery.com

Frequently Asked Questions About Surplus Funds in Franklin County

How long does it take to receive surplus funds?

Timelines vary but typically range from several weeks to a few months after approval.

Does the bank get the surplus?

No. Surplus funds belong to the former owner or eligible claimant.

Can I file myself?

Yes, but errors frequently result in delays or denials.

What if multiple heirs exist?

Probate and court approval are usually required.

Are surplus funds taxable?

Consult a tax professional regarding your specific situation.

Check Your Franklin County Surplus Funds Eligibility

You can check surplus funds eligibility to determine whether funds are currently held in the court registry.

For a statewide overview, review our Florida foreclosure surplus funds guide explaining how excess proceeds are handled across all counties.

Homeowners may also review neighboring procedures such as foreclosure surplus funds in Gulf County or Bay County Clerk of Court surplus funds.

If your property is still in pre‑foreclosure, explore options to stop foreclosure in Franklin County or sell your home fast before foreclosure through our equity protection programs