Wakulla County Florida Foreclosure Surplus Funds – Official Homeowner Guide

Introduction

Surplus funds are created when a judicial foreclosure sale produces proceeds greater than the total amount owed on the final judgment, including principal, interest, attorneys’ fees, and court costs. Under Florida Statute §45.032, these excess proceeds—commonly referred to as foreclosure surplus funds—belong to the former homeowner or other legally eligible claimants.

In Wakulla County, foreclosure surplus funds are held in the court registry and administered by the Wakulla County Clerk of Court & Comptroller. The Clerk does not automatically send these funds to homeowners. A verified claim must be properly filed and, in many cases, approved by the court before disbursement occurs.

⚠️ Important distinction: Foreclosure surplus funds are not the same as tax deed surplus funds. Tax deed surplus arises from tax deed sales conducted by the county tax collector, while foreclosure surplus funds come exclusively from judicial foreclosure sales. If you are searching for Wakulla County tax deed surplus funds, you may visit the County Tax Deed Surplus page. For foreclosure surplus funds, continue reading.

How Surplus Funds Are Created in Wakulla County

Surplus funds most commonly result from the following foreclosure actions:

Judicial Mortgage Foreclosures

When a property sells at a foreclosure auction for more than the final judgment amount, the remaining balance becomes surplus funds held by the court registry.

HOA and Lien Foreclosures

Homeowners’ association foreclosures or lien foreclosures may also generate surplus funds if the sale price exceeds the lien amount and allowable costs.

In all cases, the funds are classified as judicial foreclosure sale proceeds and remain subject to court order before release.

Step-by-Step: How to File a Surplus Funds Claim in Wakulla County

Filing a claim requires strict compliance with clerk and court procedures.

Where the Funds Are Held

Surplus funds are held by the Wakulla County Clerk of Court & Comptroller, Civil Court Services Division, within the court registry.

Required Claim Documentation

Depending on the claimant’s status, required documents may include:

Government-issued photo identification

Proof of former ownership

Recorded assignments (if applicable)

Probate documentation for estates

Notarized surplus funds claim form

All submissions must constitute verified claim documentation.

Filing Deadlines

Florida law imposes statutory deadlines. Claims filed after applicable deadlines may be denied regardless of merit.

Clerk Review Process

The Clerk reviews filings for procedural compliance. Deficient filings may be rejected or require amendment.

Disbursement of Funds

Once approved, disbursement is subject to court order. Funds may be released by check, wire transfer, or approved electronic methods.

Why Surplus Funds Claims Get Denied in Wakulla County

Common reasons claims are denied include:

Missing or incorrect documentation

Probate not completed for deceased owners

Improper or non-compliant assignment agreements

Competing claims or unresolved liens

Filing after statutory deadlines

Claims initially filed without professional representation that later require correction, amendment, or litigation may be subject to modified recovery terms due to increased administrative and legal work.

Probate & Heirs: What Happens If the Owner Is Deceased

If the former homeowner is deceased, Wakulla County will not release surplus funds without proper legal authority.

When Probate Is Required

Multiple heirs exist

Title was held individually

No beneficiary designation applies

Summary vs. Formal Administration

Summary administration may apply to smaller estates

Formal administration may be required for complex or contested estates

Without court-appointed authority, funds will remain in the registry indefinitely.

Major Cities, Urban Areas & Neighborhoods in Wakulla County

Surplus funds cases commonly originate from properties located in:

Cities & Communities

Crawfordville

Sopchoppy

St. Marks

Panacea

Wakulla Gardens

High-Foreclosure Zip Codes (Examples)

32327

32346

Neighborhoods & Subdivisions

Wakulla Beach Estates

Shell Point

Magnolia Gardens

Common Foreclosure Streets

Crawfordville Highway

Shadeville Road

Coastal Highway

Local Institutions

Wakulla High School

Wakulla Springs State Park vicinity

Nearby veteran medical facilities serving the region

Why Homeowners Choose Visionary Surplus Recovery

Visionary Surplus Recovery serves as the Equity Surplus Claims Department for former homeowners and heirs throughout Wakulla County.

We provide:

Attorney-managed surplus funds claims

Clerk-compliant filings

Probate coordination included when required

No upfront fees

Reduced risk of denial and faster resolution

Clients receive regular updates, transparency throughout the process, and a final distribution summary showing the total amount awarded by the county and the exact net amount disbursed.

We also teach clients how to verify claim status independently by reviewing public court records.

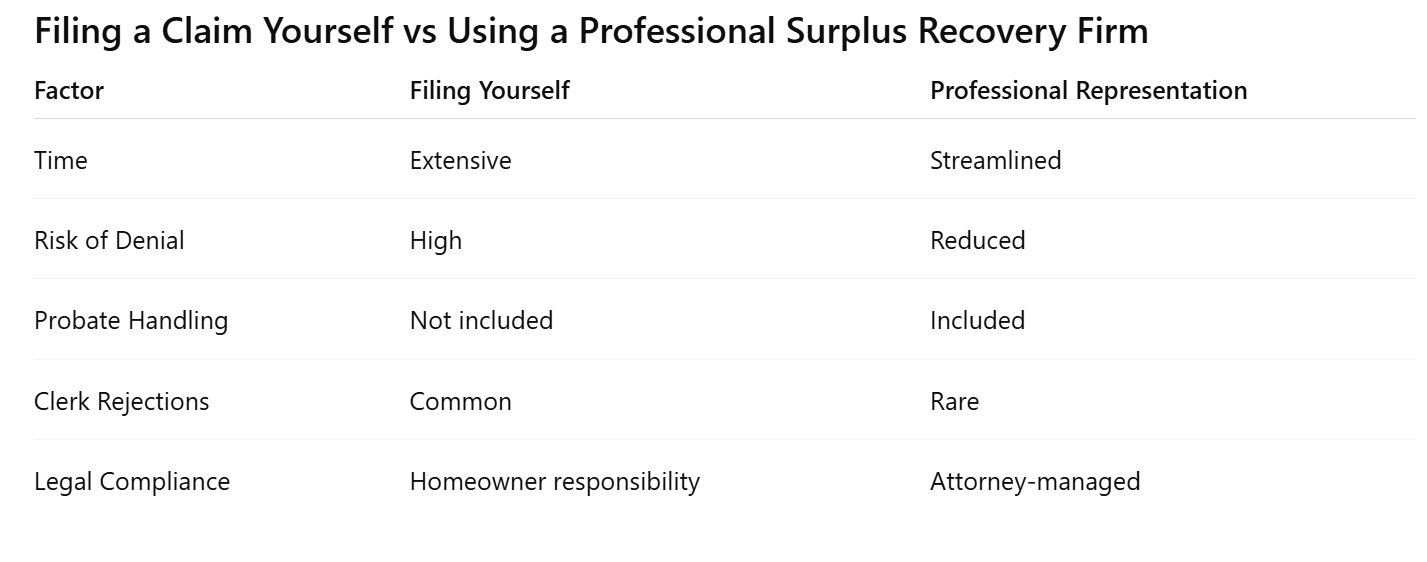

Filing a Claim Yourself vs. Using a Professional Recovery Firm

This comparison is informational only and not intended as legal advice.

What Happens If You Do Nothing

If no valid claim is filed:

Funds may eventually escheat

Lienholders may intervene

Claims become legally complex over time

Pre-Foreclosure Help & Selling Before Auction

If your property has not yet gone to foreclosure auction, options may exist to protect your equity.

Homeowners searching to stop foreclosure in Wakulla County, sell a house fast, or receive a cash offer before foreclosure may contact Visionary Estates UPP LLC, which handles cash acquisitions only.

📞 Call David, Cash Acquisitions Manager: 813-335-8082

📧 Email: cashoffers@visionarysurplusrecovery.com

Properties may qualify for as-is purchase, fast closings (sometimes under 7 days), and no repair requirements.

What Happens After You File a Claim

Clerk review timelines vary by case volume

Court approval may be required

Distribution issued after judicial authorization

Call to Action

You can check surplus funds eligibility using our Free Surplus Eligibility Tool or request a county-specific evaluation for Wakulla County foreclosure surplus funds.

Frequently Asked Questions About Surplus Funds in Wakulla County

How long does it take to receive surplus funds?

Timelines vary but commonly range from several weeks to several months depending on court approval.

Does the bank get the surplus?

No. Once the final judgment is satisfied, surplus funds belong to the former owner or eligible claimants.

Can I file the claim myself?

Yes, though many claims are delayed or denied due to procedural errors.

What if multiple heirs exist?

Probate or court determination is typically required.

Are surplus funds taxable?

Tax implications vary. Consult a qualified tax professional.

Wakulla County Resources

Homeowners may also benefit from reviewing the Florida foreclosure surplus funds guide, neighboring county procedures, or learning how to protect your home equity before foreclosure through available equity protection options.