Lake County Florida Foreclosure Surplus Funds – Official Homeowner Guide

Understanding Foreclosure Surplus Funds in Lake County, Florida

Under Florida Statute §45.032, surplus funds (also referred to as excess proceeds) are created when a judicial foreclosure sale generates more money than what is required to satisfy the final judgment, court costs, and authorized fees.

In Lake County, Florida, these surplus funds do not belong to the bank, lender, HOA, or winning bidder. By law, surplus funds belong to the former homeowner or other legally eligible claimants, such as heirs, estates, or properly authorized assignees.

After a foreclosure sale, surplus funds are typically deposited into the court registry and are held by the Lake County Clerk of Court & Comptroller, pending proper disbursement through a verified claim process. Funds are not automatically sent to former owners and require affirmative action to recover.

This guide explains how foreclosure surplus funds work in Lake County, how to file a compliant claim, why claims are commonly denied, and why many homeowners choose to work with the Equity Surplus Claims Department at Visionary Surplus Recovery.

How Surplus Funds Are Created in Lake County

Surplus funds most commonly arise from the following foreclosure actions:

Judicial Mortgage Foreclosure Sales

When a foreclosed property sells at auction for more than the total amount owed on the mortgage judgment, the remaining balance becomes surplus funds.

HOA and Lien Foreclosures

Homeowners’ Associations and lienholders may foreclose on a property for unpaid assessments. If the property sells for more than the lien amount, surplus funds are generated.

Court Registry Handling

In all cases, surplus funds are considered judicial foreclosure sale proceeds and are held by the Lake County Clerk of Court, subject to court order and statutory priority.

Step-by-Step: How to File a Surplus Funds Claim in Lake County

Filing a foreclosure surplus funds claim in Lake County requires strict compliance with clerk and court procedures.

1. Determine Where the Funds Are Held

Surplus funds are held in the court registry under the custody of the Lake County Clerk of Court & Comptroller – Civil Court Services Division.

2. Prepare Required Claim Documentation

Commonly required documentation includes:

Government-issued photo ID

Proof of former ownership

Final judgment and case number

Assignment agreement (if applicable)

Death certificate and probate filings (if deceased owner)

All documentation must be verified, legible, and clerk-compliant.

3. Probate & Authority Review

If the former owner is deceased, the Clerk will not release funds without proper probate authority or court-recognized legal standing.

4. Filing Deadlines

Claims must be filed within statutory deadlines. Failure to act timely may result in loss of priority or additional legal hurdles.

5. Clerk Review & Court Approval

The Clerk reviews the claim for completeness. In many cases, judicial approval is required before disbursement.

6. Disbursement of Funds

Once approved, surplus funds are distributed by:

Court-issued check

Wire transfer

Zelle (when permitted)

Disbursement is always subject to court order.

Why Surplus Funds Claims Get Denied in Lake County

Surplus funds claims are frequently delayed or denied due to:

Incorrect or missing documentation

Incomplete or invalid assignments

Probate not initiated or finalized

Competing claims from heirs or lienholders

Filing after statutory deadlines

Improper claimant authority

Claims initially filed without professional representation that later require correction, amendment, or litigation may be subject to modified recovery terms, including a higher recovery fee, due to the additional work required.

Probate & Heirs: What Happens If the Owner Is Deceased

When a former homeowner has passed away:

Probate is typically required

Summary vs. formal administration depends on estate value

Counties will not release funds without court-recognized authority

Multiple heirs require judicial determination

This is one of the most common reasons surplus funds remain unclaimed in Lake County.

Major Cities, Urban Areas & Neighborhoods in Lake County

Cities & Municipalities

Clermont

Leesburg

Eustis

Mount Dora

Tavares

Minneola

Groveland

Common High-Foreclosure Areas & ZIP Codes

34711, 34748, 32726, 32757, 34715

Neighborhoods & Communities

The Villages (Lake County portion)

Greater Hills

Vista Grande

Pine Lakes

Spring Valley

Example Streets Seen in Foreclosure Filings

US Highway 27

SR-50 (Colonial Drive)

County Road 455

Hancock Road

Notable Institutions

South Lake Hospital

AdventHealth Waterman

Lake-Sumter State College

Lake Technical College

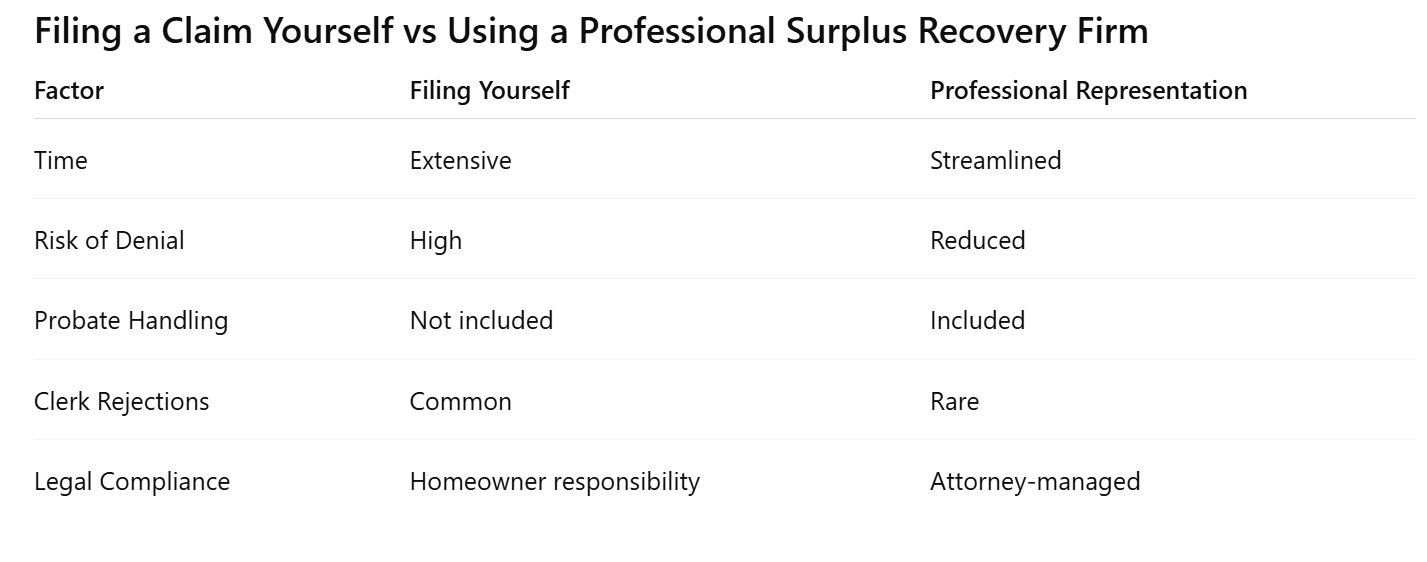

Filing a Claim Yourself vs. Using a Professional Surplus Recovery Firm

What Happens If You Do Nothing

Funds may eventually escheat

Lienholders may intervene

Claims become legally complex

Priority rights may be lost

Surplus funds are not held indefinitely without consequence.

Pre-Foreclosure Help in Lake County (Before Auction)

If your home is still in pre-foreclosure, you may have options to:

Stop foreclosure

Protect your equity

Sell your home as-is

Close in as little as 7 days

You may receive a cash offer directly from Visionary Estates UPP LLC, our official partner.

Contact:

David – Cash Acquisitions Manager

📞 813-335-8082

Why Homeowners Choose Visionary Surplus Recovery

Visionary Surplus Recovery operates as the Equity Surplus Claims Department, offering:

Attorney-managed claims

Clerk-compliant filings

Probate included

No upfront fees

Reduced denial risk

Clear distribution summaries

We are not a government entity and do not guarantee outcomes, but our process mirrors official county procedures for accuracy and compliance.

What Happens After You File a Claim

Clerk review (30–90 days typical)

Court approval if required

Disbursement issued upon order

Timelines vary based on complexity.

Frequently Asked Questions About Surplus Funds in Lake County

How long does it take to receive surplus funds?

Typically 30–90 days after approval.

Does the bank get the surplus?

No. Surplus funds belong to the former owner or eligible claimant.

Can I file myself?

Yes, but errors commonly lead to delays or denials.

What if multiple heirs exist?

Probate and court determination are required.

Are surplus funds taxable?

Consult a tax professional.

Take Action Now

✅ Free Lake County Surplus Evaluation

✅ Attorney-Managed Claim Review

Lake County Homeowner Resources

Linked Pages:

Homeowners may also benefit from reviewing the Florida foreclosure surplus funds guide, or neighboring county procedures such as foreclosure surplus funds in Seminole County and Orange County Clerk of Court surplus funds.

If your property has not yet gone to auction, explore options to stop foreclosure in Lake County or sell your home fast before foreclosure through our equity protection programs.